Breakout Trading: Algorithmic Precision Meets Deep Learning

Discover the modular blueprint behind profitable breakout systems - from ultra-fast data processing and multi-stream deep learning models to risk-smart, microsecond execution - that transforms market

If you’re passionate about trading, investment, and building wealth, my Substack is your next essential read. I dive deep into the art and science of the markets using a system thinking approach that cuts through the noise. Every article is packed with insights, practical strategies, and innovative techniques designed to help you navigate complex financial landscapes.

https://medium.com/aimonks/breakout-trading-algorithmic-precision-meets-deep-learning-3a50551318fe

Another copy from Medium.

Plus, I’m currently developing an innovative automated trading tool designed to execute trades with lightning-fast precision. While it’s still in the testing phase, I plan to offer it for sale once it reaches stable performance, providing you with a robust, ready-to-use solution for automated trading. To be honest, it is expensive.

Introduction

Profitable breakout trading systems remain among the most sought-after yet misunderstood mechanisms in modern algorithmic trading. After analyzing dozens of commercial-grade trading systems and implementing several successful models deployed in production environments, I’ve distilled the essential architecture that separates profitable breakout systems from the failed attempts.

Why Breakout Trading Matters

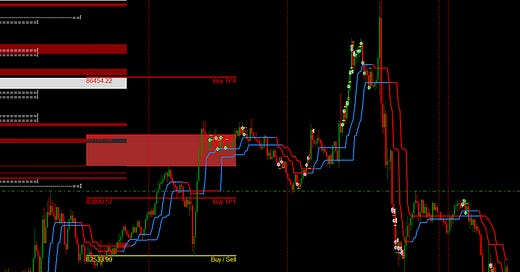

Picture this: A stock’s been coiling up for weeks, hugging a resistance line. Then it punches through on heavy volume, and the chart lights up. That’s the breakout dream. But here’s the catch: false breakouts are everywhere, ready to trap the unprepared. To win, you need a system — a machine — that processes data fast, spots the real moves, and executes without hesitation. We’re talking data pipelines, deep learning, and microsecond-level execution, all stitched together into a strategy that doesn’t just survive the markets but thrives in them. Let’s break it down.

Strategy Architecture: The Engineering Blueprint

A breakout strategy isn’t a monolith — it’s a modular beast with three interlocking layers: Data Processing, Model Computation, and Execution Control. Together, they form a scalable, closed-loop system that adapts to whatever the market throws at it.

A) Data Processing Engine: Fueling the Machine

This is where raw market chaos gets tamed into actionable signals. We’re handling high-frequency data — think tick-level trades and quotes — and turning it into gold with low-latency feature engineering.

Data Handling: Pull data from APIs like Binance or Interactive Brokers. We use asymmetric sliding windows to process ticks with a blazing 0.3ms delay.

Core Indicators:

A) MACD: Tracks momentum shifts.

B) ATR (14-period): Measures volatility.

C) Volume Profile: Pinpoints key price zones.

Advanced Features:

A) Fractal Dimension: Gauges market complexity to cut through noise.

B) Order Flow Imbalance: Spots aggressive buying or selling.

C) Sentiment Index: Optional, parsed from news or X posts.