China's 10 Million Jobs on the Line??: Unraveling the True Cost of the US‑China Tariff War

A data‑driven analysis of China unemployment intensities, relocation economics, and whether the US can maintain its hardline trade stance.

https://www.reuters.com/markets/emerging/bessent-says-china-could-lose-10-million-jobs-tariffs-2025-04-29/

Introduction

The assertion by the US Treasury Secretary that the tariff war is expected to cost China ten million jobs has ignited considerable debate and scrutiny. This bold claim, made against the backdrop of escalating trade tensions characterized by substantial tariffs imposed by both the United States and China, warrants a thorough examination of the underlying economic factors and potential consequences. As of April 2025, the United States has levied tariffs as high as 145% on goods imported from China, prompting retaliatory tariffs from Beijing reaching up to 125% on American products. Understanding the validity and implications of such a significant job loss projection requires a detailed analysis of the affected industries, the feasibility of production relocation, the competitive landscape, and the long-term sustainability of the current trade policies.

Industry Distribution and Productivity of the Potentially Unemployed

To understand the potential impact of the tariff war on employment in China, it is crucial to analyze the industry distribution and productivity characteristics of the unemployed population. Based on 2017 data, the unemployment landscape in China was distributed across several key sectors: Manufacturing (19.5%), Information Computer Software (17.5%), and Wholesale and Retail (7.5%). The unemployment intensity, which measures the responsiveness of unemployment to changes in output, was highest in Wholesale and Retail at 1.46, while Manufacturing exhibited an intensity of 1.21.

http://ier.ruc.edu.cn/upfile/file/20200507/20200507221329_36207.pdf

If we were to distribute a hypothetical loss of ten million jobs proportionally based on these 2017 figures, approximately 1.95 million jobs would be lost in the manufacturing sector, 1.75 million in Information Computer Software, and 0.75 million in Wholesale and Retail. The remaining 5.55 million job losses would be distributed across other sectors of the economy.

The manufacturing sector in China is characterized by a mature mid-to-high-end system with standardized production capabilities. Many Chinese manufacturers adhere to international certifications such as ICTI (International Council of Toy Industries) and CPC (China Compulsory Certification), reflecting a focus on quality and global market standards. Job losses in this sector could significantly impact China's export capabilities, which have long been a driver of its economic growth. Similarly, unemployment in the burgeoning Information Computer Software sector could impede China's progress in technological innovation and its ambitions to become a leader in the digital economy. Reduced employment in the Wholesale and Retail sector would likely dampen domestic consumption, further impacting overall economic activity.

It is important to note that the overall unemployment rate in China has remained relatively stable in recent years. In March 2025, the urban unemployment rate stood at 5.20%. The average urban unemployment rate in 2024 was 5.1%, and in the first quarter of 2025, it was recorded at 5.3%. These figures suggest that while specific sectors might face challenges due to the trade war, the overall employment situation has not yet reflected a massive loss of ten million jobs. However, the 2017 data on industry distribution might not entirely represent the current economic structure, as China has undergone significant economic transformation and technological advancement in the intervening years.

The unemployment intensity data provides a crucial layer of understanding. The higher unemployment intensity in the wholesale and retail sector (1.46) compared to manufacturing (1.21) suggests that the service sector, which includes wholesale and retail, is more sensitive to economic downturns. For the same level of economic contraction caused by the tariff war, a larger proportion of the workforce in wholesale and retail could become unemployed compared to manufacturing. This indicates that if the trade war significantly impacts consumer spending and overall economic activity, the retail sector might experience a more pronounced increase in unemployment rates.

Composition and Estimation of Reconstruction Costs (Toy Industry Example)

To understand the potential economic disruption caused by the tariff war, it is useful to examine the costs associated with relocating manufacturing capacity outside of China. Using the toy industry as an example, we can estimate the initial investment and operating costs of setting up production in an alternative location like Bangladesh.

https://www.gsnmc.com/post/why-top-toy-manufacturers-in-china-still-lead-global-production-in-2025

The initial investment for a medium-sized toy factory in a remote area of Bangladesh could range from $3 million to $5 million. This includes land acquisition ($100k-$500k), factory construction ($500k-$1M), procurement of second-hand equipment ($1M-$2M), and personnel training (3-6 months at approximately $500 per person).

Operating costs in Bangladesh present a different picture compared to China. While the monthly salary for a worker in Bangladesh is significantly lower at $80-$100, their productivity is also considerably lower, estimated at only 60%-70% of a Chinese worker's output. Raw materials, such as plastic pellets, if imported, could see a cost increase of 20%-30%. Logistics costs are also expected to rise by 15% due to port inefficiency and a transportation cycle that is 1-2 weeks longer. Consequently, the overall unit product cost in Bangladesh could be 25%-40% higher than in China.

Reconstructing equivalent productivity to China poses significant challenges. Chinese toy factories typically operate at a massive scale, employing tens of thousands of workers. In contrast, Bangladeshi factories average only 500-1000 employees. To replace the output of a single large Chinese factory, it would be necessary to build 10-20 similar-sized factories in Bangladesh, requiring a total initial investment of $3 billion to $10 billion. Furthermore, obtaining certifications like the US standard CPC involves additional testing fees, ranging from $50k to $100k per certification, and compliance costs, such as upgrades to environmental equipment.

The toy industry in China benefits from advanced manufacturing systems and automation, which have led to significant cost reductions and increased productivity. These levels of automation and efficiency are not easily replicable in other countries without substantial investment and technological expertise. The overall cost of reconstructing equivalent productivity outside of China could reach 1.5-2 times that of China's original system, and it might take 3-5 years to achieve stable operation. This significant cost differential and time lag highlight the difficulty and expense of rapidly shifting manufacturing away from China.

Can New Capacity Compete with Existing Chinese Manufacturers?

While the tariff war might incentivize the creation of new manufacturing capacity in other countries, competing with established Chinese manufacturers presents a complex set of challenges.

https://www.china-briefing.com/news/childs-play-opportunities-china-toy-industry/

https://cpgsourcing.com/best-toy-manufacturers-in-china-and-suppliers-for-sourcing/

https://economictimes.indiatimes.com/news/international/business/toy-manufacturers-shift-from-china-is-no-childs-play-as-countries-struggle-to-match-up/articleshow/106880581.cms?from=mdr

In the short term, new factories might gain regional market advantages. In the US market, potential tariff exemptions under schemes like the Generalized System of Preferences (GSP) and geopolitical preferences could offer a temporary edge. However, higher logistics costs, such as the 30% increase in shipping from Bangladesh to the US East Coast compared to China, could offset these advantages. In other markets like the EU and Southeast Asia, Chinese manufacturers have already mitigated tariff impacts through localization strategies, as seen with companies like Haier in Europe, and they possess higher brand recognition among consumers.

Long-term competitive disadvantages loom large for new capacity. Factories in countries like Bangladesh often rely on a fragile cost structure heavily dependent on low wages, which can constitute 30%-40% of their total costs. These wages are also subject to significant annual growth rates of 8%-10%. In contrast, China has strategically reduced its reliance on labor costs, bringing them down to below 15% of total costs through investments in automation. This makes new capacity more vulnerable to rising labor costs over time.

Technical barriers also pose a significant hurdle. The pass rate for ICTI certification among Chinese toy manufacturers in Shenzhen is a mere 5%, indicating the stringent standards and the difficulty for new entrants to meet them quickly. Leading Chinese companies that have achieved these certifications often form a monopolistic advantage, making it challenging for new factories to attain the same level of credibility and market access.

Furthermore, new capacity faces a considerable market backlash risk. If the US were to remove the tariffs, Chinese manufacturers, with their vast economies of scale and mature supply chains, could rapidly reclaim orders. This swift return of Chinese competition could lead to the bankruptcy of newly established factories that have made substantial fixed investments in setting up operations. The efficiency and scale of China's toy manufacturing sector, which accounts for approximately 70% of global production, create a formidable competitive landscape for any new entrants. The established infrastructure, specialized supply chains, and technological advancements in China provide a significant advantage that is difficult for other countries to replicate quickly.

In essence, while new manufacturing capacity might find localized and temporary success, it is unlikely to fundamentally alter the global dominance of Chinese manufacturers in the long term. The established players in China benefit from a comprehensive ecosystem, significant scale, and ongoing technological advancements that provide a sustained competitive edge.

Can the US Persist in Its Uncompromising Stance in the Long Run?

The ability of the US to maintain its current uncompromising stance on trade with China in the long run is increasingly questionable due to a confluence of fiscal pressures, the complexities of industrial chain transfer, historical precedents, and domestic political considerations.

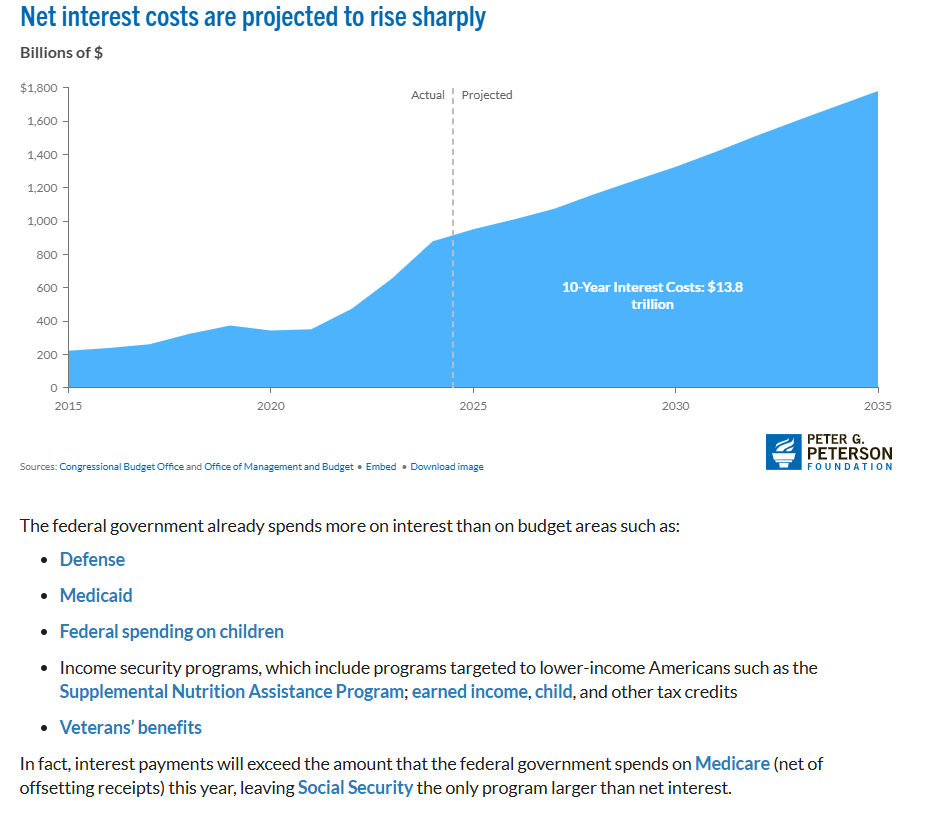

The US is facing significant fiscal pressures stemming from its unsustainable national debt and the associated interest payments. As of April 2025, the US national debt reached $36.1 trillion, with $9.2 trillion maturing within the year. The interest expenditure on this debt is projected to reach $1.3 trillion in 2025, an amount that could potentially exceed the combined spending on defense and healthcare. Furthermore, the willingness of foreign entities, including China, Japan, and Europe, to purchase US debt has been declining, with their holdings decreasing from 40% to 30%. This reduced foreign demand necessitates increased purchases by the Federal Reserve, which can contribute to inflationary pressures.

https://www.pgpf.org/article/what-is-the-national-debt-costing-us/

https://www.pgpf.org/programs-and-projects/fiscal-policy/monthly-interest-tracker-national-debt/

https://www.congress.gov/crs-product/IN12045

https://www.jec.senate.gov/public/vendor/_accounts/JEC-R/debt/Monthly%20Debt%20Update.html

The transfer of industrial chains from China to other countries is proving to be a complex and often speculative endeavor. There is a tendency for industrial transfer to focus on sectors with short production cycles and quick returns on investment, such as garment OEM, rather than long-cycle industries like semiconductors. The example of the Hengtong Photovoltaic Cable Project, which achieved payback relatively quickly but relied on policy subsidies, highlights the challenge of achieving market-driven competitiveness in relocated industries. Additionally, the US needs to provide substantial tax incentives and infrastructure assistance to countries like Vietnam and India to attract manufacturing, potentially adding approximately $200 billion to its annual fiscal expenditure, further straining the budget.

Historical experience suggests that the US has adjusted its trade strategies under fiscal pressure. The 1985 Plaza Accord, an agreement among major industrial nations to depreciate the US dollar, demonstrates a past instance of the US collaborating to address trade imbalances. Similarly, the 2018 US-China Phase One Agreement, while limited in scope and ultimately not fully realized, indicates a willingness to negotiate and potentially compromise on trade issues. Domestic political pressure could also play a significant role. If the failure of industrial chain transfer leads to a rise in unemployment, particularly in key sectors like the automotive industry, before the 2025 midterm elections, the administration might face pressure to adopt a more conciliatory approach.

https://www.atlanticcouncil.org/blogs/new-atlanticist/china-is-ready-to-eat-bitterness-in-the-trade-war-what-about-the-us/

https://carnegieendowment.org/china-financial-markets/2021/01/how-trumps-tariffs-really-affected-the-us-job-market?lang=en

https://budgetlab.yale.edu/research/fiscal-and-economic-effects-revised-april-9-tariffs

https://taxfoundation.org/research/all/federal/trump-tariffs-trade-war/

Considering the mounting fiscal pressures, with the debt interest payment ratio reaching 14.6% in 2025, and the slow progress of large-scale manufacturing return, the US may face significant pressure to reconsider its trade policies with China in the 2026-2027 timeframe. The tariffs themselves have been estimated to negatively impact US GDP and potentially lead to job losses within the US. This economic pain within the US, coupled with China's demonstrated resilience and ability to implement countermeasures, suggests that the current uncompromising stance may not be sustainable in the long run.

Overall Conclusion

The US-China tariff war presents a stark asymmetry in terms of cost and competitiveness. The effort to reconstruct China's vast and efficient manufacturing productivity in other regions is proving to be a costly and protracted process, fraught with inefficiencies. Meanwhile, China continues to fortify its industrial advantages through strategic investments in automation, technological upgrades, and adherence to international quality and safety certifications.

The United States finds itself in a strategic dilemma. The unsustainable trajectory of its national finances, coupled with the often speculative and fiscally demanding nature of attempting to rapidly transfer complex industrial chains, suggests a limited capacity to maintain an uncompromising trade war stance indefinitely.

In response to the US tariffs, China has been implementing a multi-pronged strategy. This includes a concerted effort to shift its significant foreign trade capacity towards its own massive domestic market, emphasizing "same line, same standard, same quality" to cater to local consumers. Simultaneously, China is actively diversifying its export destinations, focusing on expanding trade with third countries. Furthermore, there is the potential for China to strategically absorb transferred capacity by acquiring struggling or bankrupt factories in other regions, thereby maintaining its global manufacturing footprint.

Ultimately, the current dynamics suggest that the trade war is more likely to conclude with a degree of compromise from the United States, driven by the mounting economic and fiscal pressures. This potential easing of tensions would likely coincide with a continued deepening of China's industrial upgrading as it adapts to the evolving global economic landscape. While ongoing talks between the two nations offer a glimmer of hope for de-escalation, the underlying strategic competition remains a significant factor in the future of this complex trade relationship. The long-term implications of this trade war will depend on the ability of both nations to navigate their respective economic challenges and find a path towards a more stable and predictable trade environment.

If you’d like to show your appreciation, you can support me through:

✨ Patreon

✨ Ko-fi

✨ BuyMeACoffee

Every contribution, big or small, fuels my creativity and means the world to me. Thank you for being a part of this journey!