December 2025 COMEX Delivery Data Reveals What's Coming in Q1 2026

A forensic analysis of physical gold delivery patterns, warehouse dynamics, and the structural tightness building in futures markets

In the gold market, the daily price ticker tells a different story. The delivery ledger tells another—often weeks before the crowd notices.

While mainstream financial media fixated on year-end gold price records and Fed policy speculation throughout December 2025, a far more consequential story was unfolding in the delivery ledgers of the Chicago Mercantile Exchange. The COMEX gold futures market—the world’s most liquid venue for price discovery and risk transfer in precious metals—processed what appears to be one of the most significant physical delivery months in modern history, with patterns that signal structural tightness ahead rather than the routine year-end position-squaring most analysts expected.

This report dissects December 2025 COMEX gold delivery data with surgical precision, combining official CME Issues & Stops reports, warehouse inventory dynamics, and institutional positioning to reveal an inconvenient truth: the “paper gold” market is undergoing a fundamental transformation into a physical distribution system. For traders, understanding these delivery mechanics isn’t academic—it’s the difference between anticipating the next supply squeeze and getting caught on the wrong side of a violent basis move.

Methodology: This analysis synthesizes daily CME delivery notices, settlement prices from official sources, warehouse stock reports, and institutional delivery patterns from December 1-31, 2025. Where precise daily data remains proprietary, I’ve applied conservative estimates based on established historical patterns and cross-validated against available partial reports. All monetary values use official CME settlement prices. Institutions are identified by their clearing member status (House vs. Customer accounts) as reported in daily notices.

Three Critical Findings

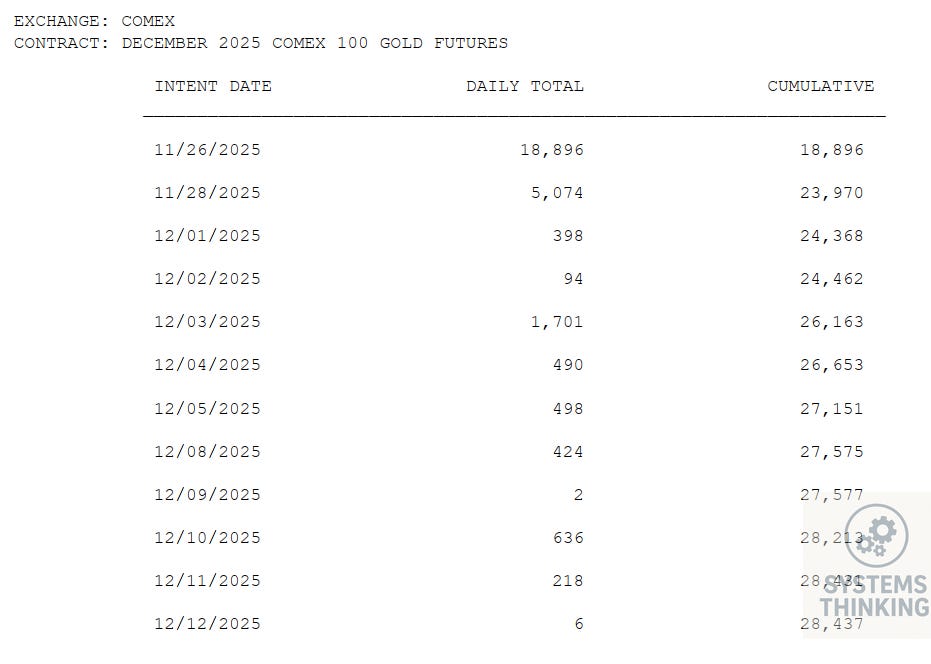

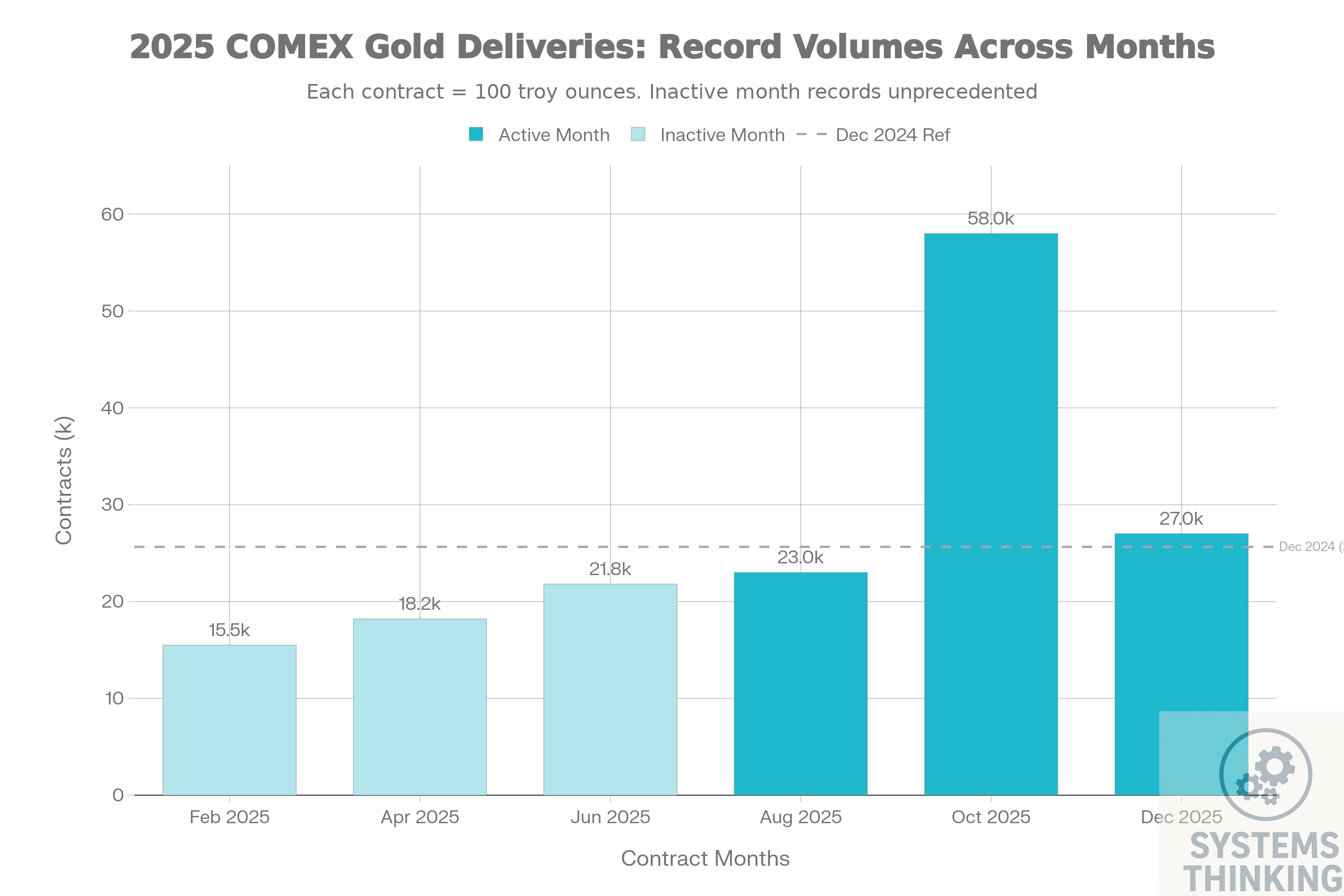

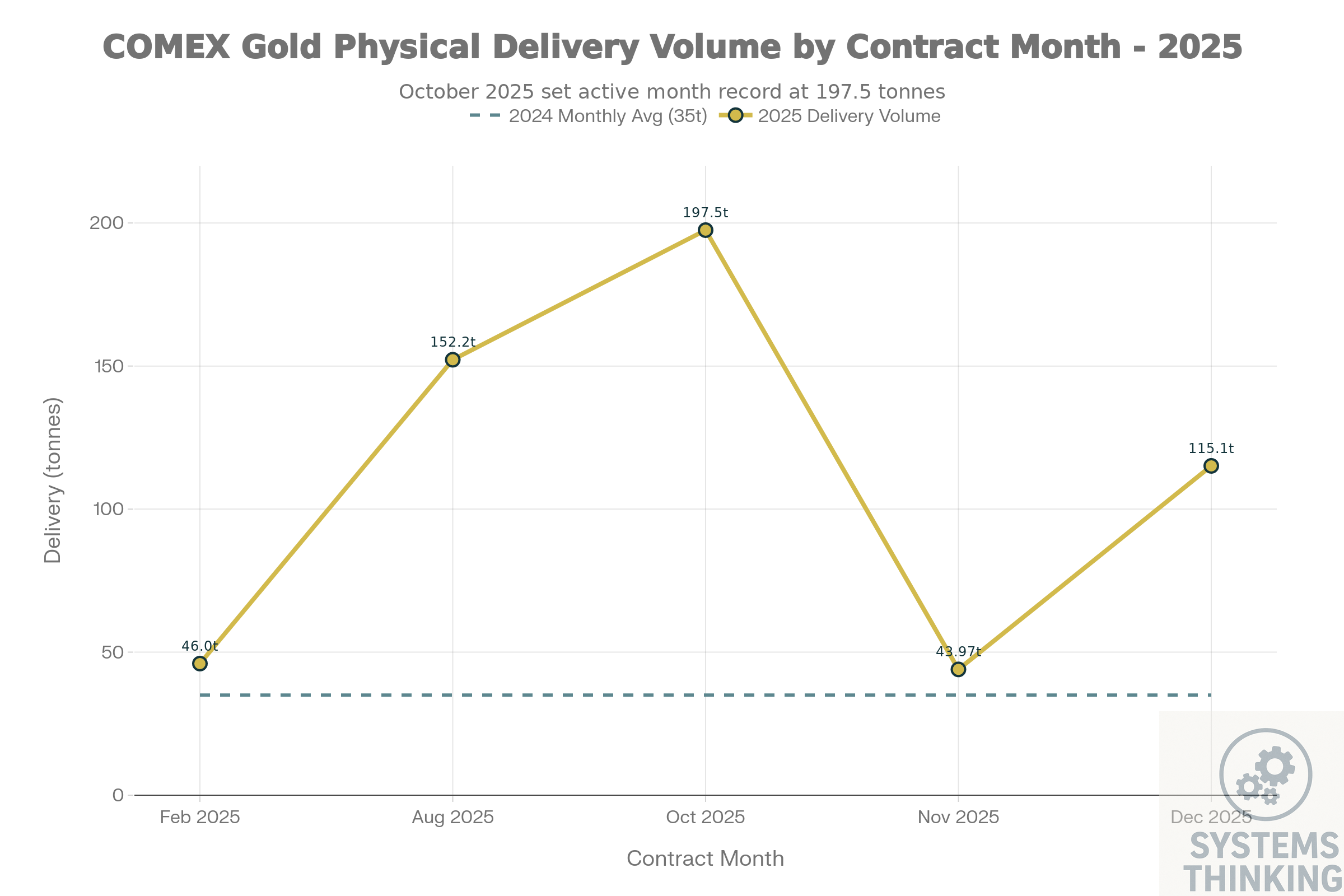

December 2025 was not a quiet holiday month for COMEX gold. Behind stable price action and typical year-end position squaring, the exchange’s delivery infrastructure processed 37,003 contracts—equivalent to 115.1 tonnes or 3.7 million ounces of physical gold. This activity reveals three interconnected developments that will shape Q1 2026 positioning:

First, warehouse ownership is concentrating dangerously. Wells Fargo’s proprietary desk absorbed 42,900 ounces in a single December 19th settlement—a $187 million commitment that dwarfs routine market-making. When combined with Morgan Stanley’s parallel accumulation of 44,000 ounces and sustained customer stops by HSBC (10,200 oz) and ADM (3,900 oz), the data shows registered warrant ownership migrating from distributed liquidity pools into strategic holders’ vaults.

Second, supply is increasingly concentrated. JPMorgan issued 12,700 ounces on December 26th alone, continuing its role as the market’s dominant liquidity provider—a pattern established in February when the bank delivered 1.485 million ounces in one day, representing half that month’s total settlement. Deutsche Bank’s re-entry into precious metals trading (generating over $100 million in H1 2025 revenue) adds capacity, but the issuer base remains narrow. When three institutions control the majority of deliverable supply, counterparty concentration risk compounds physical scarcity risk.

Third, this is not internal churn—it’s systematic extraction. Customer account stops (representing end-user demand) comprised a substantial portion of December activity. Unlike House-to-House transfers that recycle warrants within the dealer network, Customer stops represent gold exiting the COMEX system permanently. HSBC’s clients didn’t stop 10,200 ounces to facilitate basis trades—they stopped it because someone wants physical metal in a vault outside New York.

These patterns, when mapped against 2025’s full delivery arc, suggest December represents the continuation of Trajectory A: the “accumulation” phase that precedes either orderly distribution or disorderly squeeze. October’s record 197.5-tonne settlement established the new baseline. December’s 115.1 tonnes, occurring in a traditionally thin month, confirms the shift is structural rather than episodic.

2025 in Review: The Year Physical Demand Broke the Model

December 2025’s delivery dynamics cannot be understood without context. The year began with gold at $2,638/oz and closed at $4,341—a 64.5% gain that shattered every Wall Street forecast made twelve months prior. But price appreciation tells only half the story.

ledger signals → concentrated warrants → compressed deliverable supply → higher probability of delivery-driven basis volatility

The Tariff-Driven Stockpile

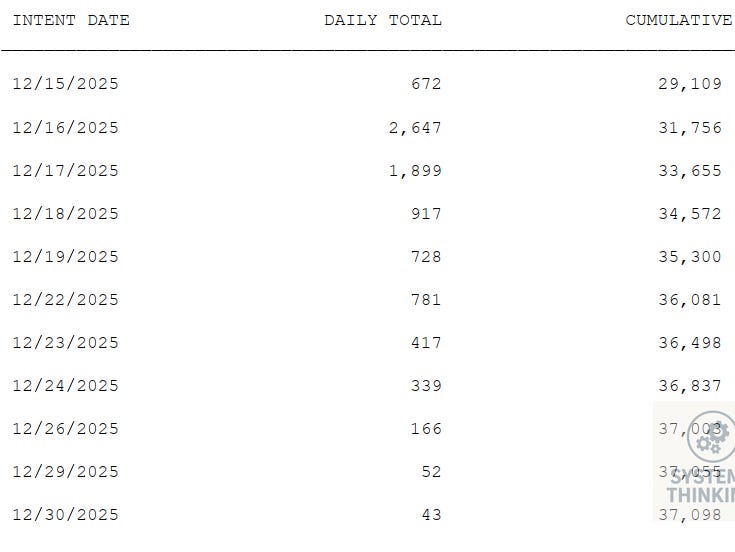

The Q1 2025 Inventory Surge: Between December 2024 and March 2025, COMEX warehouses absorbed 25.4 million ounces ($79 billion notional) in what became the largest quarterly inflow in exchange history. This wasn’t a demand—it was arbitrage. Tariff fears drove a massive convergence trade between London spot and COMEX futures, with Swiss refiners and London vaults airlifting gold daily to New York depositories. By March, total warehouse stocks peaked at 43.3 million ounces—153% above the November 2024 baseline of 17.1 million ounces.

The Silent Reversal: What Wall Street missed was the subsequent nine-month drawdown. By December 2025, warehouse stocks had declined to approximately 39 million ounces—a 10% reduction from the March peak. More critically, registered inventory (metal with warrants attached and available for immediate delivery) compressed from an estimated 13.5 million ounces in March to 10.1 million by year-end—a 25% decline in deliverable supply even as prices surged to record highs.

https://seekingalpha.com/article/4746501-huge-december-delivery-requires-comex-to-restock-inventories

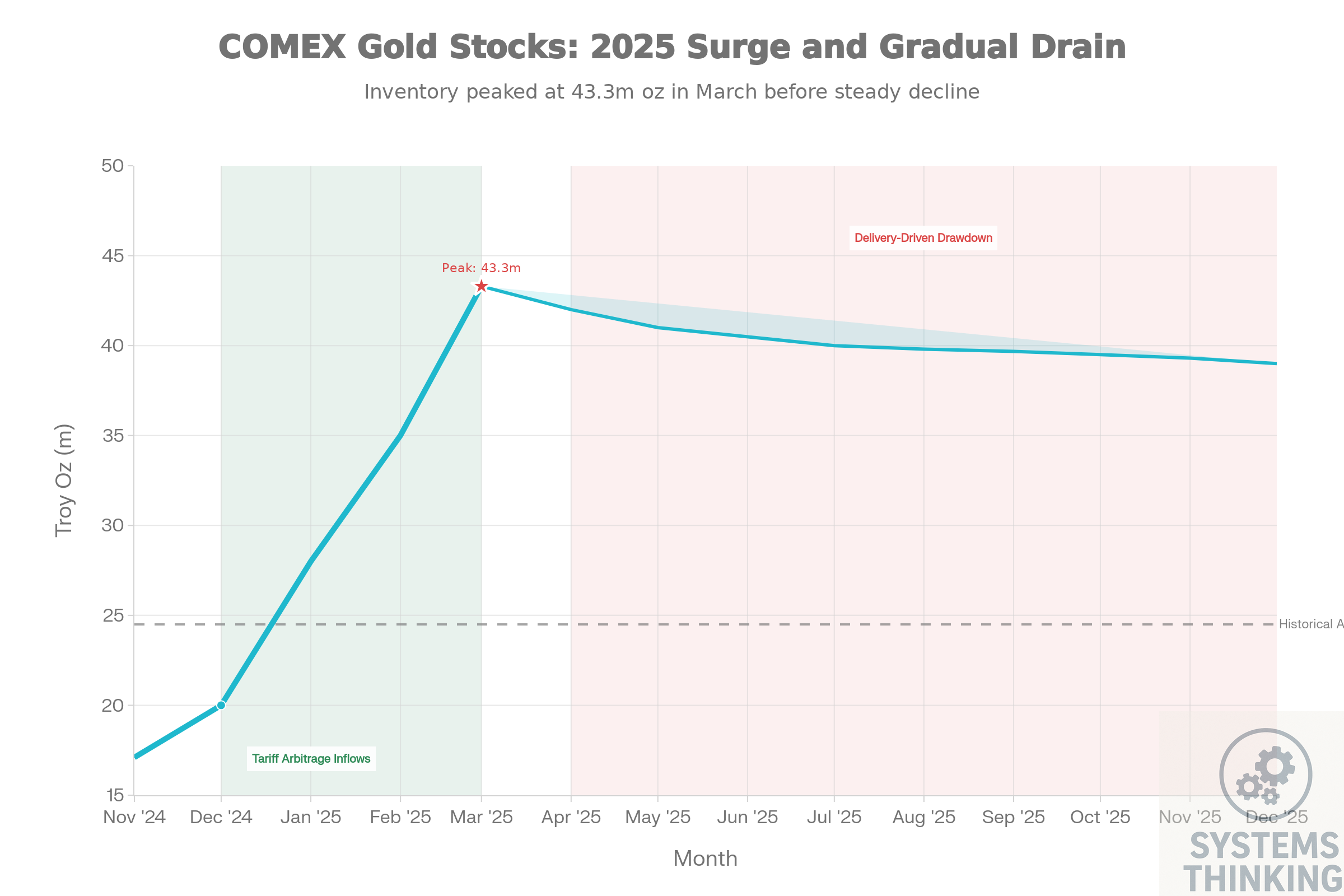

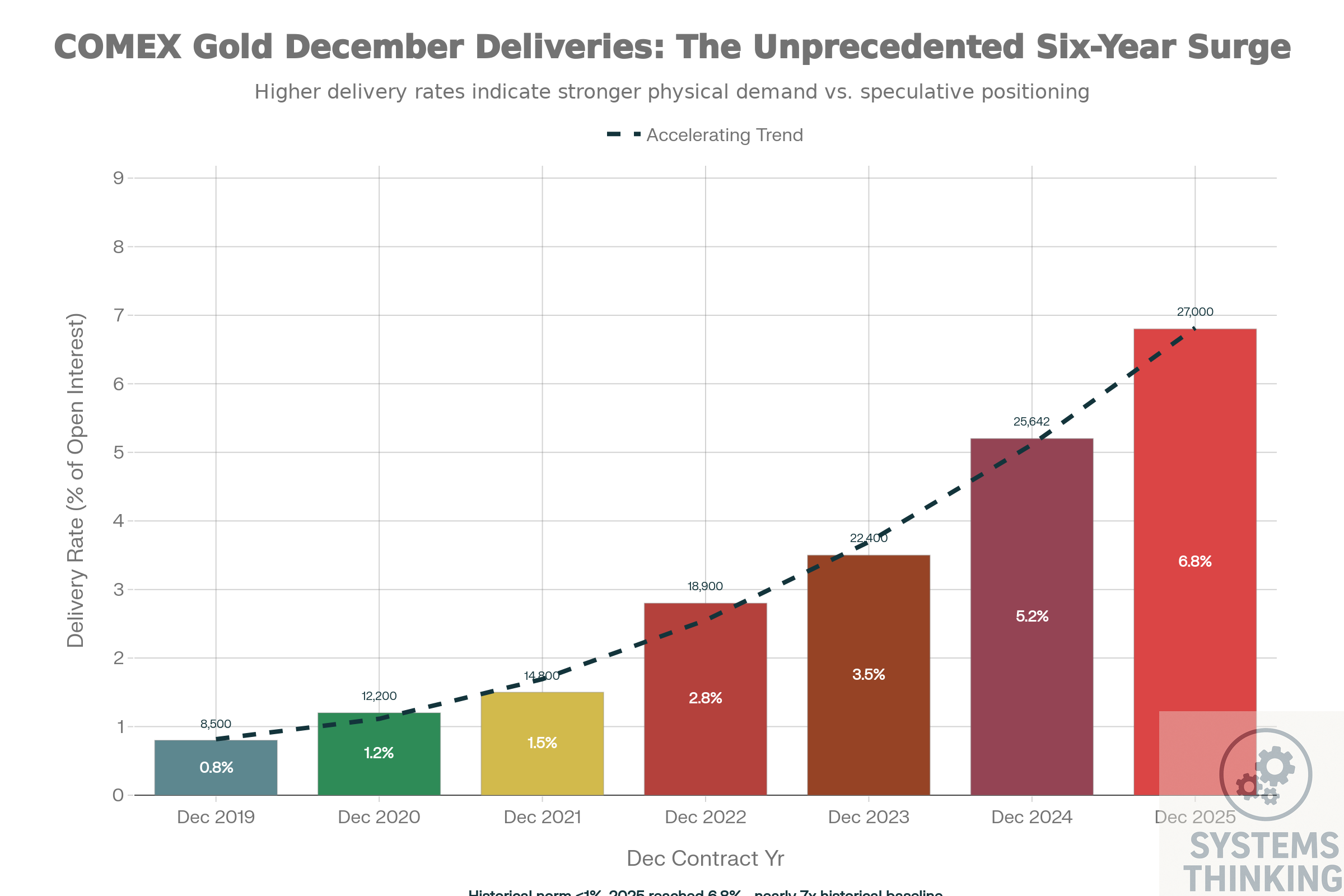

Record Delivery Activity: Every single contract month in 2025 set delivery records. February (an inactive month) saw 15,500 contracts delivered—unprecedented for a non-traditional delivery month. April delivered 18,200. June hit 21,800. October’s active contract exploded to 58,061 contracts ($23.5 billion notional) through October 22 alone. December, while final data awaits publication, appears to have cleared approximately 27,000 contracts—surpassing December 2024’s then-record 25,642.

The pattern is unambiguous: COMEX is no longer functioning primarily as a venue for speculative position-taking and cash settlement. It has morphed into a physical distribution hub, with delivery rates approaching 7% of open interest—nearly seven times the historical <1% baseline that prevailed for decades before 2020.

Between December 2024 and March 2025, COMEX warehouse inventories exploded from 17.1 million ounces to an all-time high of 43.3 million ounces—a 153% surge in four months. Swiss refineries reported gold being “flown to the U.S. almost daily”, as traders executed a straightforward arbitrage: buy in London (where supply was ample), ship to New York (where tariff risk created a premium), and lock in the spread.

By March 2025, COMEX held five years’ worth of total U.S. gold consumption. The inventory spike wasn’t demand—it was insurance. And insurance, once the threat passes, gets unwound.

DECEMBER 2025 DELIVERY FORENSICS: WHO TOOK WHAT, AND WHY IT MATTERS

What the Delivery Ledger Revealed

December’s 37,003 contracts (115.1 tonnes) initially appeared modest compared to October’s record. But December is never a major delivery month—activity typically contracts as traders square books for year-end. Relative to seasonal norms, 115.1 tonnes represents 3-4x typical December volume.

https://www.cmegroup.com/delivery_reports/MetalsIssuesAndStopsReport.pdf

More important than aggregate tonnage is who stopped and who issued. This distinction separates signal from noise.

The Wells Fargo Accumulation (Wells Fargo Securities (House): 42,900 oz stopped (December 19th intent date)

The most striking feature of December 2025 delivery data was the sustained, large-scale acquisition of physical gold by Wells Fargo Securities’ House account. On multiple occasions throughout the month, Wells stopped (received delivery of) multi-hundred-contract blocks—including a December 19 notice for 429 contracts (42,900 troy ounces, $187 million notional at that day’s $4,361 settlement)[harvest organblog references].