Order Block + MACD + EMA: 5-Minute Intraday Futures Edge

Follow institutional "Order Block" signals, confirm momentum with MACD, and ride EMA trends to master quick, high-probability futures trades.

Introduction

Before diving into the details, here’s what you need to know: This Order Block + MACD + EMA combination strategy is specifically designed for 5-minute intraday trading, offering remarkable consistency. I’ll show you not just how to identify patterns and entry signals, but also share practical tips to boost your win rate. This straightforward approach is perfect if you’re tired of guessing market directions.

The Hidden Power of Institutional Footprints

The biggest trap in trading-whether stocks, crypto, or futures-is entering positions randomly based on gut feelings rather than systematic analysis. The “Order Block + MACD + Moving Average” combination solves this fundamental problem.

Orderblocks - Indicators and Strategies - TradingView

orderblocks - Check out the trading ideas, strategies, opinions, analytics at absolutely no cost! - Indicators and…www.tradingview.com

At its core, this strategy helps you understand the “smart money” playbook by identifying Order Blocks. When institutional investors establish positions, they leave distinct footprints (Order Blocks) in specific price regions. When price returns to these areas, there’s a high probability of a bounce or reversal. It’s like following VIP players at a casino-retail traders can’t access the private rooms, but following the big players rarely steers you wrong.

Simply put, this combined strategy helps you:

See exactly where big money is buying and selling (Order Blocks)

Immediately determine momentum strength or weakness (MACD)

Quickly identify whether the trend is up or down (EMA lines)

This method is specifically engineered for 5-minute intraday trading, perfect for quick battles without having to stay up all night or gamble on tomorrow’s movements.

Setting Up Your Trading Arsenal

To make implementation straightforward, here’s how to set up this strategy on TradingView. For those using other platforms, you’ll need to find equivalent indicators or adapt these settings.

Step 1: Add the Double MACD Overlay

Enter TradingView and search for “Double MACD Overlay [NLR]” to add it to your chart. Use the default parameters (12,26,9,3). This specialized indicator plots two MACD signals directly on your price chart, helping you spot trends and momentum shifts more clearly than standard MACD.

Double MACD Overlay [NLR] - Indicator by NonLinearRookie

This indicator plots two MACD signals directly on your price chart to help you spot trends and shifts in momentum more…www.tradingview.com

Step 2: Add the Math by Thomas Order Blocks

Search for “Math by Thomas OB” and add it to your chart. This indicator automatically marks red and green order blocks and overlays three moving averages: 9-day (yellow), 21-day (blue), and 50-day (red).

Math by Thomas Order Blocks- Indicateur par MathThomas

🔥 Description: 🚀 Math by Thomas Order Blocks is a precision tool for Smart Money Concept (SMC) and price action…fr.tradingview.com

Pro Tip: Make the order blocks semi-transparent to avoid obscuring price action. Navigate to Indicator → Style → Transparency and adjust to about 30%.

The Order Block indicator identifies institutional trading zones where large orders are placed, helping you recognize potential reversal and continuation areas. It detects Bearish OBs when price sharply reverses after a significant bullish move and identifies Bullish OBs following a sharp reversal from a bearish push.

Mastering the Art of Trend Recognition

Understanding when to enter and exit trades is critical. Here’s how to effectively trade using this system:

Bullish Entry Conditions

Enter a long position when all these conditions align:

Price pulls back to a green order block (where smart money is lurking)

MACD histogram shifts from red to green (indicating strengthening momentum)

Closing price rises above both 9 EMA and 21 EMA (structure turning bullish)

9 EMA crosses above 21 EMA (confirming stronger bullish trend)

Entry: Buy at the close of the candle that satisfies all conditions

Stop Loss: Place below the order block or the recent low

Target: Next resistance level or the next red order block

The 9 EMA strategy is particularly effective for identifying short-term market trends. When a security’s price crosses above the 9-day EMA, it generates a buy signal. Combined with order blocks, this signal becomes significantly more reliable.

Bearish Entry Conditions

Enter a short position when all these conditions align:

Price touches a red order block (where institutions are distributing)

MACD histogram changes from green to red (momentum weakening)

Closing price falls below both 9 EMA and 21 EMA (structure turning bearish)

9 EMA crosses below 21 EMA (trend weakening)

Entry: Short at the close of the candle that satisfies all conditions

Stop Loss: Place above the order block or recent high

Target: Next support level or green order block

9 EMA Trading Strategy: Rules, Setup, Performance And Backtest - QuantifiedStrategies.com

The 9 EMA trading strategy is a widely used technical analysis indicator strategy among traders to identify short-term…www.quantifiedstrategies.com

Real Trading Insights

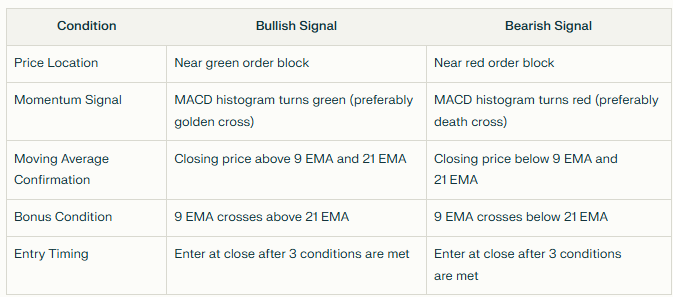

The core logic of this strategy can be summarized in one simple table:

It’s that simple: location + momentum + trend.

For practical trading, consider these additional tips:

Avoid choppy markets: If the ATR (Average True Range) value is low, it indicates a “sticky” market condition-don’t force trades. ATR calculates the average of true ranges over a specified period, providing a comprehensive measure of volatility compared to simply looking at the day’s price range.

Wait for confirmation: Don’t rush in just because the MACD histogram changes color. Wait for 2 candles of confirmation before taking action.

Respect key levels: Combine with previous day’s highs/lows or round numbers for higher win rates.

How to Use Average True Range (ATR) in Day Trading?

Learn effective strategies for utilizing Average True Range (ATR) in day trading to enhance your trading decisions and…tiomarkets.com

ATR: Technical Indicator

Learn how the Average True Range (ATR) indicator helps traders measure volatility, optimise stop-loss placement, and…academy.ftmo.com

Why This System Consistently Outperforms

The essence of the Order Block Trading System is “following the smart money without getting burned”: use order blocks to locate institutional cost areas, MACD to confirm momentum, and moving averages to filter trends.

Remember, you’re not competing against the market-you’re battling human psychological weaknesses. Here are the golden rules that have kept my trading account growing:

Trade quality over quantity-limit yourself to maximum 2 trades per day.

Only enter when Order Blocks + MACD + EMAs all align.

Never risk more than 8% of your total capital on a single trade.

Avoid opening new positions after 3 PM (to dodge end-of-day volatility).

During weekly reviews, first examine losing trades to check if they violated any rules.

The beauty of this system lies in its application of Fair Value Gap (FVG) principles. A Fair Value Gap is a price imbalance formed when the market moves quickly, leaving a gap between candle wicks. Traders anticipate these gaps will later fill, signaling potential trade entries.

By combining order blocks (which essentially identify these institutional value areas) with momentum confirmation from MACD and trend validation from moving averages, you’re creating a multi-faceted approach that accounts for position, power, and direction-the three essential components of any successful trade.

Conclusion

The Order Block Trading System isn’t just another indicator-based strategy-it’s a framework for understanding institutional behavior. When you see a green order block form after a sharp bearish movement, you’re witnessing where smart money stepped in to buy. When price returns to test that level with confirming signals from MACD and EMAs, you’re being handed a high-probability trading opportunity.

What makes this approach powerful is its simplicity combined with its multi-factorial confirmation. You’re not just trading based on a single signal-you’re waiting for position (order blocks), momentum (MACD), and trend (EMAs) to align before pulling the trigger.

Remember that no strategy works 100% of the time, but by following these guidelines and exercising proper risk management, you’ll significantly tip the odds in your favor. In the end, consistent profitability comes not from hitting home runs but from making disciplined, evidence-based decisions trade after trade.

The next time you see price approaching a clearly defined order block with MACD shifting color and EMAs confirming the move, you’ll know exactly what to do-and more importantly, why you’re doing it.

If you’d like to show your appreciation, you can support me through:

✨ Patreon

✨ Ko-fi

✨ BuyMeACoffee

Every contribution, big or small, fuels my creativity and means the world to me. Thank you for being a part of this journey!