Revolutionizing Finance: Exploring Cutting-Edge AI Tools for Smart Investments and Risk Management

Unveiling the Power of GPT-Based Models, Open-Source Chat Systems, and Innovative Plugins in the Financial Sector

GPT demonstrates many applications in the financial sector. In enterprise settings, it excels at analyzing financial reports and credit records for risk assessment and credit analysis, aiding in the precise evaluation of credit risks. It also contributes significantly to financial product recommendations, market research, compliance reviews, and fraud detection. This technology is anticipated to enhance operational efficiency and customer experiences in financial institutions. Despite these advantages, financial institutions grapple with challenges ranging from data processing and analysis to ensuring model transparency and interpretability when integrating AI comprehensively.

On an individual level, GPT finds utility in intelligent investment consulting, quantitative analysis, web crawling, text summarization, and market review. It offers a swift implementation to enhance the efficiency of investment research.

FinGPT Large Language Model

https://codesandbox.io/p/github/pjbruno327/FinGPT/master

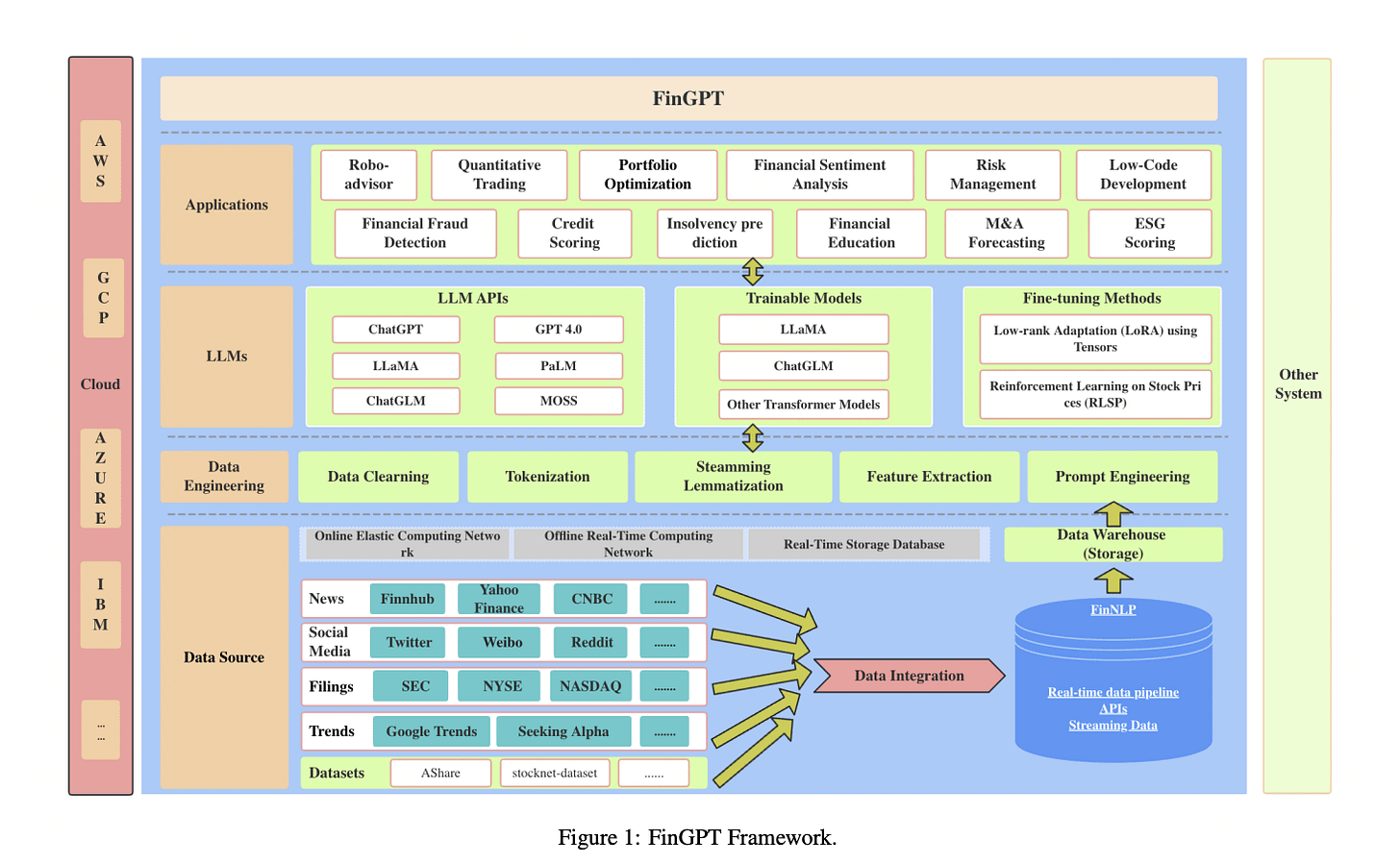

FinGPT is designed for the finance sector.

The data source layer ensures comprehensive market coverage, addressing the temporal sensitivity of financial data through real-time information capture.

The data engineering layer focuses on real-time natural language processing (NLP), a crucial aspect of financial analysis.

The next layer involves Large Language Models (LLMs) for fine-tuning methodologies, and enhancing the model’s accuracy and adaptability.

The application layer showcases FinGPT’s practical applications, serving as a demonstration platform.

FinGPT’s future lies in democratizing financial knowledge, breaking barriers, and transforming the financial landscape by freely sharing information. The purpose is to navigate the complexities of financial markets with intelligent, automated assistance, revolutionizing financial analysis and providing a foundation for fintech applications.

2. XuanYuan 2.0

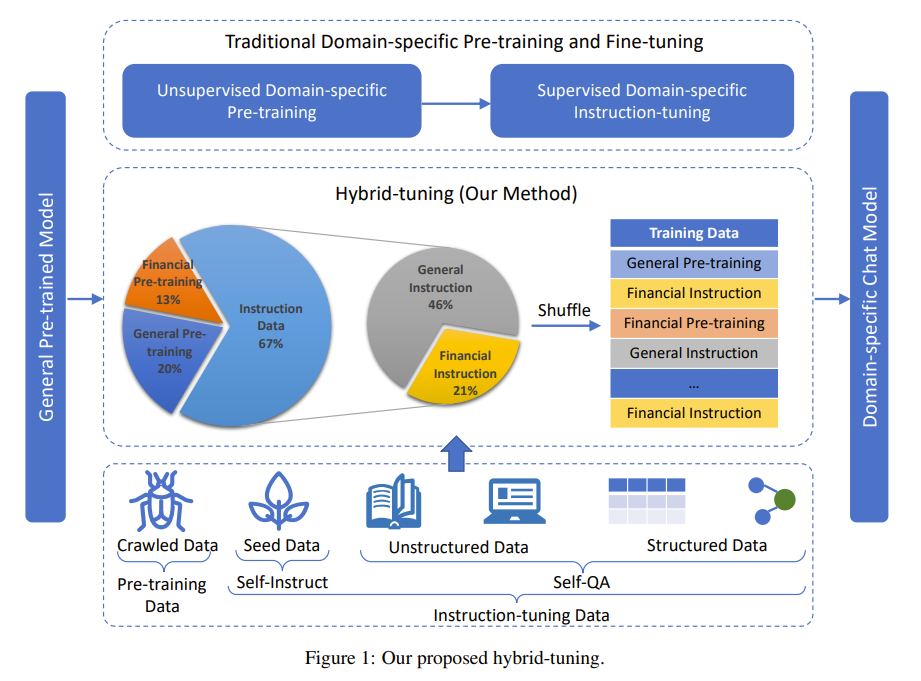

XuanYuan 2.0, the first open-source 100-billion-level large-scale Chinese chat model Xuanyuan is designed for the Chinese finance domain.

Built upon the BLOOM-176B architecture, XuanYuan 2.0 addresses the lack of open-sourced chat models in Chinese finance at a scale of hundreds of billions, boasting 176 billion parameters.

XuanYuan 2.0 employs a unique hybrid-tuning method, mitigating catastrophic forgetting by blending general and domain-specific knowledge during both pre-training and fine-tuning

Leveraging large-scale internet datasets, XuanYuan 2.0 combines unsupervised pre-training data from the internet with human-written seed instructions for general data and a mix of unstructured and structured financial data for domain-specific instruction tuning.

XuanYuan 2.0’s training utilizes NVIDIA A100 80GB GPUs, DeepSpeed distributed training, and pipeline parallelism for efficient processing.

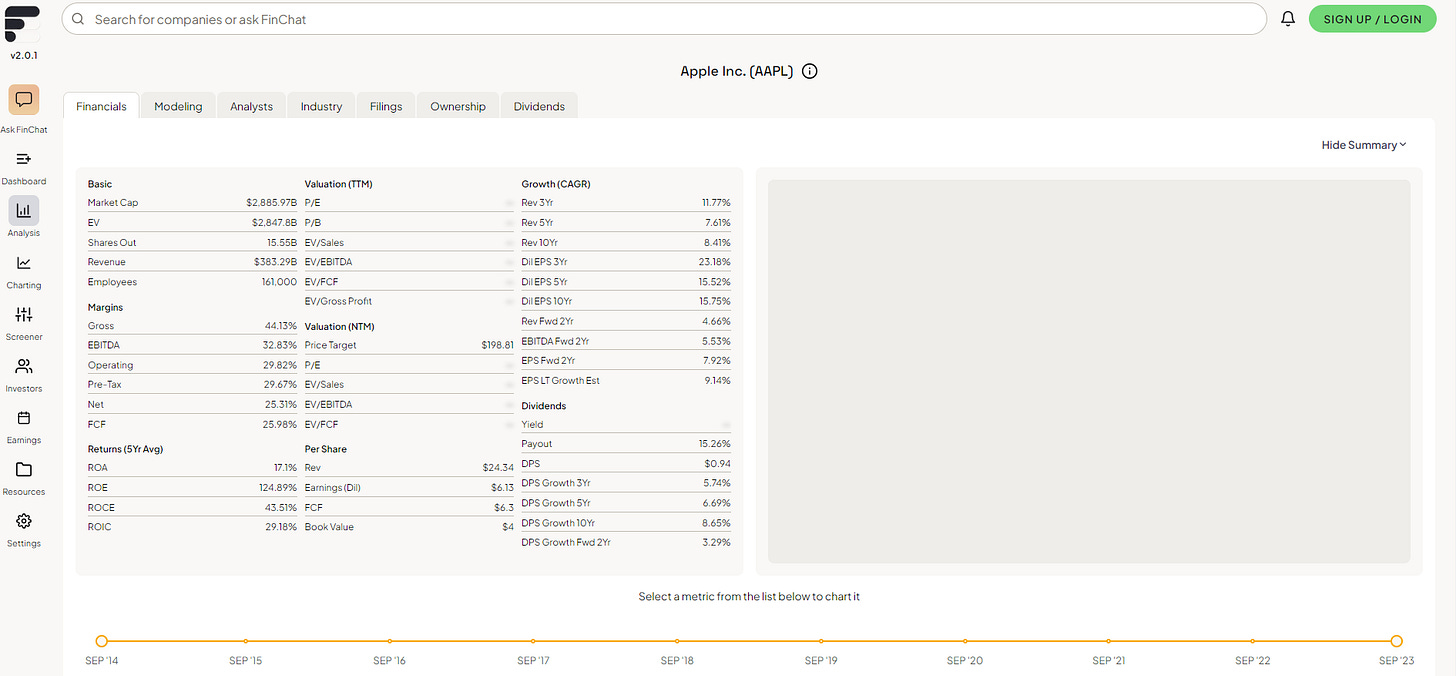

3. FinChat.io

FinChat.io operates as an AI-driven investment platform, functioning as a comprehensive finance analyst similar to ChatGPT.

Covers 750+ companies, including industry giants like Apple, Microsoft, Amazon, and Alphabet.

Offers insights into over 100 super investors.

Houses 10,000+ financial indicators for a comprehensive financial data repository.

Users can analyze specific metrics like gross margin, production, and delivery data.

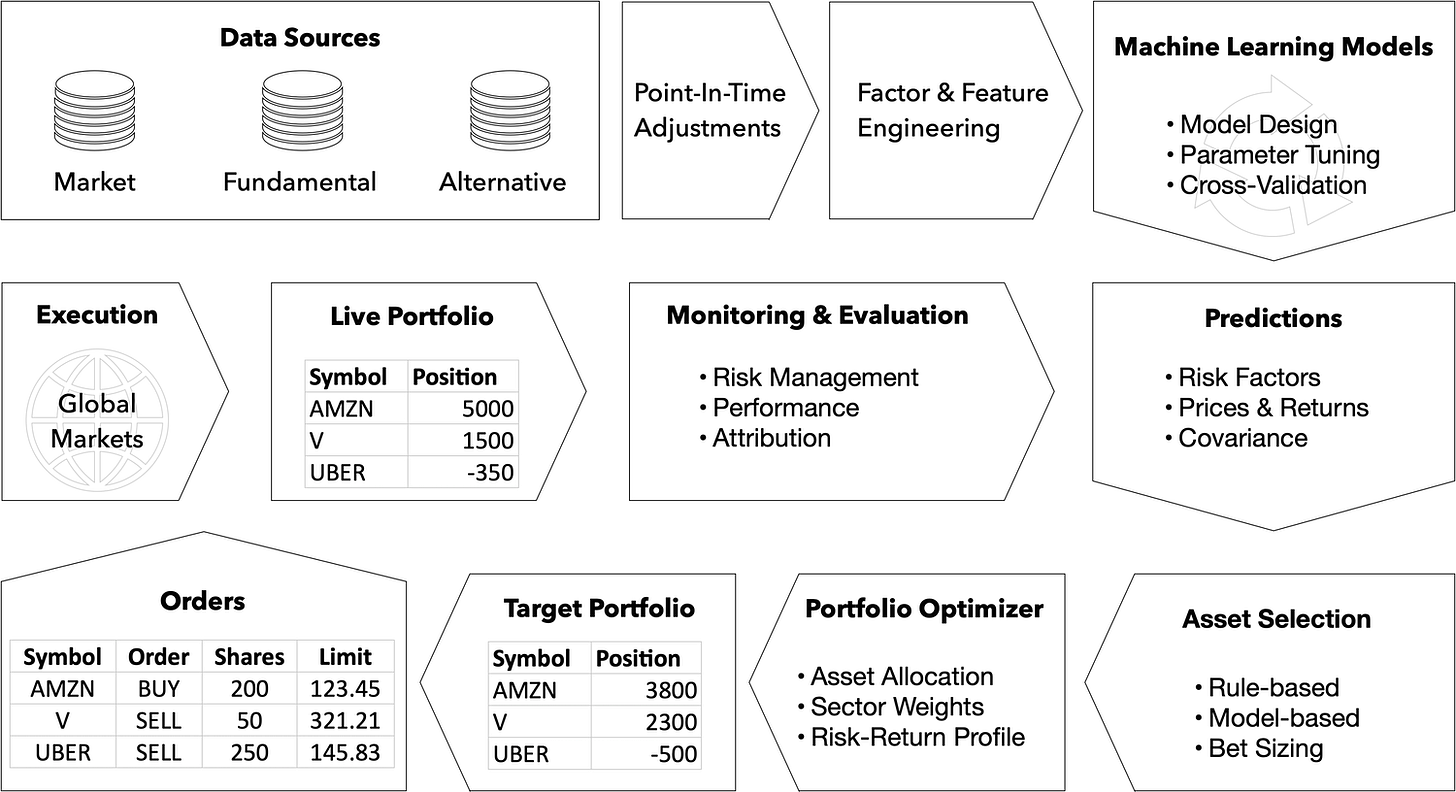

4. The end-to-end machine learning for trading workflow

Link: https://github.com/stefan-jansen/machine-learning-for-trading?utm_source=talkingdev.uwl.me

The GitHub repository provides 800 pages of tutorials and 150 example notebooks, it serves as a valuable asset for acquiring practical knowledge in machine learning and gaining insights into its real-world applications, particularly in the financial domain.

Algorithmic trading involves using computer programs to automate trading strategies.

ML applications include data mining for feature extraction, supervised learning for alpha factor creation, aggregation of signals into a strategy, asset allocation, strategy backtesting, and reinforcement learning.

Different algorithmic objectives include trade execution, short-term trades, behavioral strategies, and strategies based on absolute and relative price predictions.

5. OpenBB

OpenBB Terminal serves as a free alternative to traditional financial terminals, offering a command-line interface for extensive data analysis and visualization.

Users can create and automate research workflows through Jupyter, covering fundamental analysis and market data utilization.

Optimizing financial queries involves leveraging the complementary advantages of OpenBB and LlamaIndex.

Traditional vector storage methods face limitations, but combining metadata and existing query languages enhances result quality.

LlamaIndex, with its efficient indexing strategy, ensures accurate and reliable results at optimal query speed. This synergy revolutionizes financial data queries, improving processing efficiency and reducing corporate operating costs.

In the competitive financial market, adopting OpenBB and LlamaIndex is a crucial strategy for enterprises seeking a competitive edge.

Alternative products compared to QuantRocket, Finviz, Bloomberg Terminal, AlphaSense, EquityRT, Verity

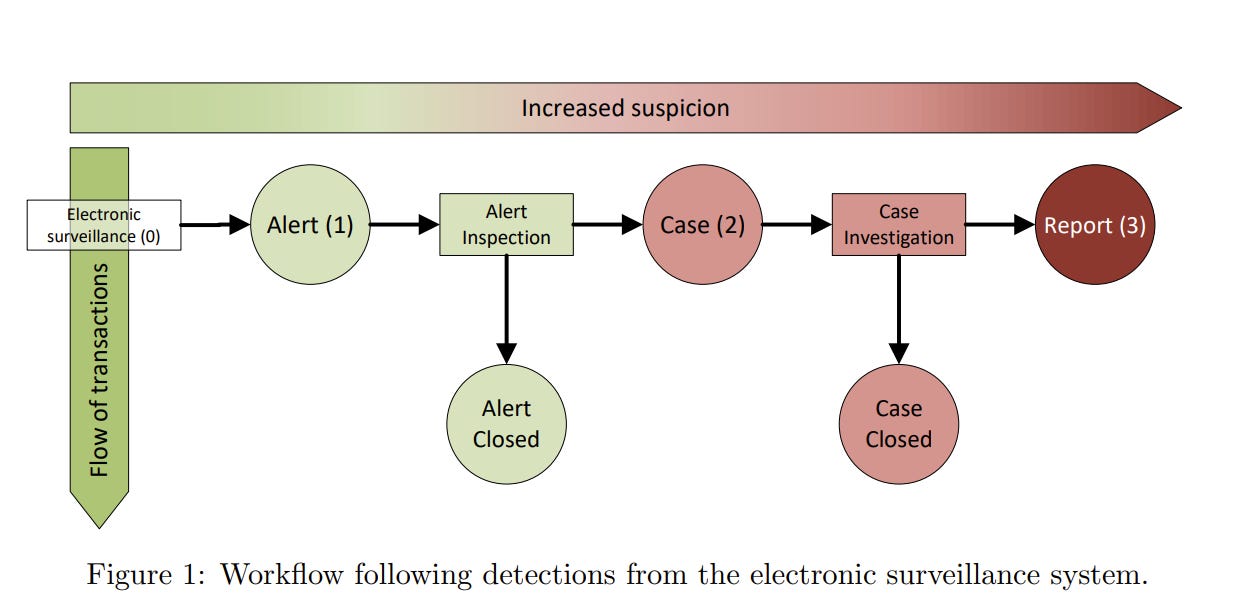

6. Finding Money Launderers Using Heterogeneous Graph Neural Networks

The HMPNN is designed for detecting money laundering by extending the MPNN to operate on heterogeneous graphs, using real-world data from DNB, Norway’s largest bank.

GNNs, especially HMPNN, are explored in AML to overcome rule-based system limitations.

Emphasis on heterogeneous graphs, capturing intricate relationships among private customers, companies, transactions, and business ties.

Edge features, crucial for effective learning, are incorporated to address gaps in existing GNN methods designed for homogeneous networks.

Novel methods proposed for aggregating embeddings across different edges of the graph enhance the learning process.

The application of HMPNN on a large real-world heterogeneous network derived from bank transactions showcases its potential to improve electronic surveillance systems for money laundering detection.

The model demonstrates effectiveness in enhancing the quality of electronic surveillance systems in detecting money laundering instances within the banking sector.

7. Magnifi

Link:

https://magnifi.com/

Magnifi is an AI-powered platform employing ChatGPT and computer programs to offer personalized investment advice.

While ChatGPT excels in processing text data such as financial news and social media dynamics., it may have limitations in analyzing numerical patterns. The platform provides AI-guided investing plans, portfolio management, and tools for stock analysis.

Users leverage Magnifi as an AI investing assistant for simplified decision-making, utilizing features like sentiment analysis to gauge public sentiment on investments.

The platform has gained popularity, with over $500 million in self-directed assets linked to it, emphasizing its role as an AI-powered financial co-pilot.

In quantitative trading, ChatGPT is crucial, automating the analysis of unstructured data, and scanning financial news, and research reports.

8. AutoGPT MetaTrader Plugin

Link: https://github.com/isaiahbjork/Auto-GPT-MetaTrader-Plugin

It integrates MetaTrader accounts with Auto-GPT, enabling traders to leverage GPT-4 for financial transactions.

The plugin supports transaction execution, account information retrieval, and market data provision, providing an automated and intelligent trading experience.

Summary

Despite large models’ capacity to handle vast information, verifying data authenticity remains difficult.

Misleading information in the market poses a risk, requiring effective noise filtration by large models to prevent misleading investment decisions.

Interpretability is another challenge; large models often function as opaque “black boxes,” lacking clear logical support for decisions. Overfitting is a concern in quantitative trading, where the complexity of large models and numerous parameters may excel in historical data but struggle to predict future market changes.

Quantitative investors must comprehend these tools’ potential and limitations, integrating them carefully into their investment processes to navigate these challenges effectively.

References

The Complete AI-Powered Stock Research Platform

FinChat.io is the all-in-one investment research platform combining institutional-grade financial data, analytics, and…finchat.io

Duxiaoman-DI/XuanYuan-70B · Hugging Face

We're on a journey to advance and democratize artificial intelligence through open source and open science.huggingface.co

GitHub - Duxiaoman-DI/XuanYuan: 轩辕:度小满中文金融对话大模型

轩辕:度小满中文金融对话大模型. Contribute to Duxiaoman-DI/XuanYuan development by creating an account on GitHub.github.com

Machine Learning for Trading

Learn to extract signals from financial and alternative data to design and backtest algorithmic trading strategies…ml4trading.io

OpenBB - An Introductory Guide to Investment Research - AlgoTrading101 Blog

OpenBB is an open-sourced investment research platform. It is used for performing investment research, optimizing…algotrading101.com

Introduction | OpenBB Docs

OpenBB is an open-source investment research software aimed at analyzing financial market data. It makes use of data…docs.openbb.co

Open-Source Finance: Is OpenBB the Future of Market Analysis?

OpenBB is an open-source alternative to the traditional Bloomberg Terminal.medium.com

If you'd like to show your appreciation, you can support me through:

✨ Patreon

✨ Ko-fi

✨ BuyMeACoffee

Every contribution, big or small, fuels my creativity and means the world to me. Thank you for being a part of this journey!