The Shadow Player: How Tether's Gold Strategy Is Reshaping the Bullion Market in 2025

Stablecoin Giant Becomes Largest Non-Sovereign Gold Holder—And the Market Should Pay Attention

TL;DR – Key Takeaways for Traders

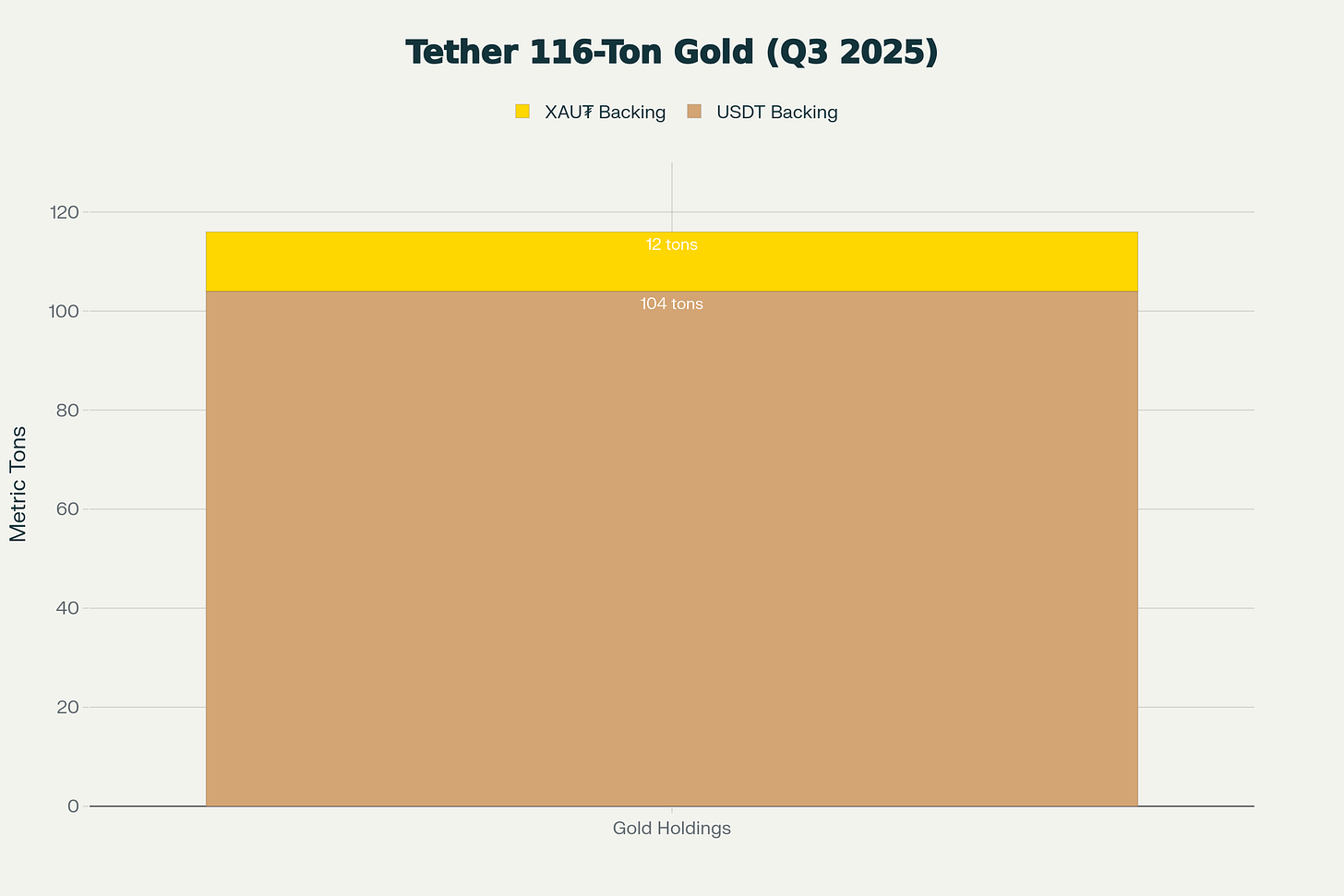

Tether holds 116 tons of gold (Q3 2025), the world’s largest non-sovereign holder, on par with mid-tier central banks—104 tons back USDT; 12 tons back XAU₮.

Tether purchased 26 tons in Q3 2025 alone, representing 2% of global quarterly gold demand and ~12% of central bank purchases—a disproportionate marginal buyer.

Gold rallied 58% YTD through November 2025 to a record $4,381/oz, driven by central banks (634 tons YTD), ETF flows ($37+ billion YTD), and Tether’s aggressive accumulation.

GENIUS Act explicitly bars gold as a reserve asset for US-compliant stablecoins, creating structural conflict with Tether’s current model and future US regulatory pathways.

Tether’s gold strategy hedges business model risk, not USDT backing—$12.9B gold and $9.9B Bitcoin holdings signal preparation for a lower-rate environment and dollar pressure.

Part I: The Quiet Gold Buyer Nobody Expected

When market participants assess gold demand in 2025, they focus on the visible suspects: central banks in BRICS nations de-dollarizing, hedge funds loading ETFs, and Indian retail demand returning. These are correct. Central banks accumulated 634 tons year-to-date through Q3; ETF inflows hit $37 billion through September—the largest semi-annual inflow since 2020.

Yet beneath these visible waves runs a different current. In November 2025, investment bank Jefferies published an analysis that shifted trader calculus: stablecoin issuer Tether had quietly become not just another buyer, but the single largest gold accumulator globally outside central banks.

The numbers justify trader attention. As of Q3 2025 end (approximately September 30), Tether held approximately 116 metric tons of physical gold, valued at roughly $14 billion at then-prevailing prices. This positions Tether on par with official reserves of mid-sized central banks: South Korea (~133 tons), Hungary (~94 tons), and Greece (~112 tons). By any measure, Tether had transformed itself into a systemic player in the gold market—and almost no one was watching.

More striking: the velocity of accumulation. Jefferies calculated that in Q3 2025 alone, Tether added approximately 26 tons. Against total global gold demand that quarter (estimated at ~1,300+ tons), this represented roughly 2% of quarterly consumption. Against the estimated 220 tons purchased by central banks in Q3, Tether’s buying accounted for approximately 12% of official sector purchases. For a non-sovereign, privately held entity, this is not marginal buying. This is a structural demand that materially tightens spot and forward supply.

The trader implication is direct: when a buyer of this magnitude enters the market in batches—and Tether’s purchases are known to occur in bulk tranches rather than smooth daily flow—it creates near-term supply compression. Over three months, 26 tons is manageable in a $500+ billion annual market. But when concentrated into a handful of large transactions, it influences both physical spot premiums and sentiment flows. Tether’s buying, according to Jefferies, “likely tightened near-term supply and boosted bullish sentiment,” which in turn fueled speculative inflows.

Tether’s 116-ton gold allocation by product type as of Q3 2025, with 104 tons supporting USDT and 12 tons backing the XAU₮ token

The question traders should ask: Is this a one-time positioning move, or the beginning of a structural shift in who sets marginal demand?

Part II: Why Tether Needs Gold—And It’s Not What You Think

The public narrative around Tether’s gold buying emphasizes reserve diversification and hedging against dollar weakness. That framing is incomplete and misses the actual economic driver.

This is where the free report ends...

Keep reading with a 7-day free trial

Subscribe to Market Architect - Gold, Stock Market, Money to keep reading this post and get 7 days of free access to the full post archives.