Weekly Macro Recap (11/23-11/29)

Market infrastructure, geopolitics and AI-capex set this week’s price agenda.

Weekly Macro Recap Nov 23–29, 2025: this week taught a blunt lesson — modern markets break on plumbing more often than on policy. When the largest derivatives venue (CME) went dark, and a mass Airbus A320 software fix grounded flights, price discovery stopped being an academic problem and turned immediately into P&L risk for anyone relying on continuous liquidity. (Primary drivers: CME outage; Airbus recall; rapidly rising Fed-cut odds.)

That combination — infrastructure shock + geopolitical headline risk + regime shifts in macro pricing — is the perfect recipe for cross-asset dislocation. Traders should care not because the narratives are sensational, but because they reprice funding, hedging costs, and safe-haven flows in minutes. Below: the top headlines (Nov 23–29, 2025) ordered by severity, concise analysis. Read with your order blotter open.

TL;DR

Airbus A320 ELAC Solar Radiation Fault → Fleet-Wide Grounding

CME Data Center Cooling Failure → 90+ Minute Futures Market Freeze

Fed Officials Signal December Rate Cut → 85% Probability; Market Reprices

Hyperscaler AI Debt Surge to $121B; Credit Spreads Widen

OpenAI’s $207B Funding Gap by 2030—Utility vs. SaaS Model Bifurcation

BlackRock IBIT Bitcoin ETF $2.2B November Redemptions; Crypto Risk-Off

Tether Gold Holdings Reach 116 Tonnes (Q3 2025); Non-Sovereign Central Bank Equivalence

Indian Rupee at Record Low 89.48/$1; RBI Reserves Drained $38B Since July

Japan JGB Foreign Investor Selloff; Yields at 17-Year Highs

Micron $9.6B HBM Fab Investment in Hiroshima; 2028 Production Ramp

Goldman Sachs Panic Index Approaches Mid-Cycle Extremes; Options Hedging Demand Surges

US Treasury Settlement Squeeze: ~$150B Liquidity Drain Over 6-Week Window

NVIDIA Q3 Record Revenue & Inventory Puzzle: Signal or Noise?

Oil Markets: OPEC+ Pause Signals Caution, but Structural Surplus Looms

UK Autumn Budget: Short-Term Fiscal Relief, Long-Term Sustainability Questions

Consumer Spending Resilience: Black Friday Record & Retail Margin Compression

China’s Semiconductor Self-Sufficiency Push: 2026–2027 Inflection Point

Key Events & Analysis

1. Airbus A320 ELAC Solar Radiation Fault → Fleet-Wide Grounding

Airbus issued an emergency technical directive for 6,000 A320 aircraft after the October 30 JetBlue incident traced to an Elevator Aileron Computer malfunction.

Incident occurred when intense solar radiation corrupted flight-control data, causing uncommanded pitch-down; the JetBlue aircraft descended without pilot input, injuring passengers. European Union Aviation Safety Agency (EASA) mandated software fix or hardware replacement before flight resumption. Airlines reported 2–72-hour groundings as maintenance facilities were already operating near capacity due to unrelated engine inspections/groundings.

The root cause—solar radiation vulnerability in ELAC firmware—highlights inadequate specification oversight by Airbus and insufficient testing of edge-case failure modes by equipment supplier Thales. Thales states its hardware meets Airbus specs; the vulnerability lies in software outside its scope. This shifts the liability debate and signals potential regulatory tightening on OEM accountability for end-to-end flight control redundancy and environmental stress-testing. American Airlines (340 aircraft initially; later clarified to ~209) faced the most significant ops impact; European and Asian carriers also took significant cancellations.

Impact: Travel insurers (AIG, XL Capital) face a spike in trip-cancellation claims; ground handling (Swissport, Servisair) loses high-margin turnaround revenue; cargo operators face backlogs; airports see reduced terminal activity and retail spend. Commercial airline margins are already compressed by fuel hedging losses and labor inflation; this temporary fleet reduction exacerbates revenue timing and forces revenue management to offer discounts to fill seats post-fix, cannibalizing fares.

Potential Policy Response: EASA/FAA may mandate expanded environmental stress-testing protocols for flight-critical systems; Airbus likely faces incremental retrofit costs and potential litigation from airlines for operational losses; Thales faces OEM quality investigation. Supply-chain implications: if Thales must redesign ELAC radiation hardening, the timeline could extend, affecting future A320 deliveries.

Probability Assessment: Additional hidden vulnerabilities in the same ELAC fleet discovered within 12 months; second-order fix required → further operational disruption by mid-2026.

Falsifiable trigger: Any additional ELAC anomaly reports by end-Q1 2026.

2. CME Data Center Cooling Failure → 90+ Minute Futures Market Freeze

November 27 CME Group outage at CyrusOne CHI1 Chicago data center halted all futures trading (equities, FX, commodities, Treasuries) for hours during the post-Thanksgiving thin-liquidity session.

At 9:40 AM ET on November 27, CyrusOne experienced chiller plant failure at its CHI1 facility, affecting CME’s primary matching engine and market data feeds. Trading resumed ~8:30 AM ET November 28 (note: timing unclear in sources; likely 90–120 minute duration). Outage occurred when volatility was low, volume depressed, and most traders still absent post-Thanksgiving—a “market holiday” effect mitigated severity. However, had the outage occurred during normal conditions, the impact would have been far worse: halt in price discovery, inability to liquidate leveraged positions, and potential cascading unwinds.

CyrusOne deployed temporary cooling equipment and restarted chillers at limited capacity. This reveals a single-point-of-failure risk: CME uses one primary data center facility; backup redundancy appears insufficient to prevent a trading halt. Peer exchanges (NYSE Arca, NASDAQ) continued trading on listings; only futures/derivatives halted, but that is the highest-volume, most liquid segment globally.

Impact: Asset managers and hedge funds that rely on futures for delta hedging and portfolio rebalancing faced execution risk and repricing uncertainty. Options market makers faced vega/skew re-calculation delays. Prop shops and algorithm traders that depend on microsecond-level latency faced model recalibration/parameter uncertainty post-restart. Broker margins, FCM funding costs spiked briefly as risk management systems flagged unhedged exposures. Retail traders on the US East Coast were most affected; offshore participants (Asia, Europe) faced a delayed morning session.

Potential Policy Response: SEC/CFTC may mandate backup data center failover capacity and redundancy testing; CME may face regulatory inquiry on operational resilience and business continuity. Potential fines or mandatory disclosure of outage-response gaps. Industry may accelerate migration to multi-cloud and decentralized order routing architecture, increasing capex for brokers and exchanges.

Probability Assessment: Repeated outage or multi-hour downtime within 18 months; regulatory mandate for 15-minute failover SLA (Service Level Agreement) by end-2026.

Falsifiable trigger: Any additional CME/CyrusOne outage lasting >30 minutes before Q4 2026.

3. Fed Officials Signal December Rate Cut → 85% Probability; Market Reprices

New York Fed President John Williams, Federal Reserve Governor Christopher Waller, and JPMorgan all signaled support for a December rate cut on November 21–27, pushing market odds from 30% to 85%.

The 55-percentage-point repricing occurred without new labor or inflation data, driven purely by Fed communication. Williams specifically cited “downside risks to employment” and stated “room for further adjustment in the near term.” Waller echoed this, saying the labor market remains “still weak.” This represents a hawkish-to-dovish pivot by officials who, just weeks earlier, had suggested pausing. The catalyst: October jobs report (delayed by government shutdown until mid-November) showed slower-than-expected hiring; forward-looking labor indicators (jobless claims, quit rates) deteriorated.

However, inflation metrics remain sticky: October PCE core inflation at 2.7%+ YoY (vs. Fed target of 2%); producer prices are also elevated. If November/December CPI or PPI surprises to the upside, market expectations may shift again, creating volatility.

Impact: Bond markets rally (10-year UST yields fall 15–30bp); USD weakens 2–4% vs. EUR, GBP, JPY; emerging market currencies (INR, BRL, PHP, MXN) strengthen modestly (though INR faces headwinds from tariff fears). Equity valuations re-rate upward as discount rates compress; mega-cap tech stocks benefit most. High-yield spreads compress; refinancing risk for BBB/B-rated corporates diminishes. Savers and retirees face lower CD/money market returns; financial stocks (banks) face margin compression if the yield curve flattens further.

Potential Policy Response: If a December cut occurs, market participants will begin pricing 2–3 cuts in 2026. If the cut is paused, Fed credibility takes a hit, and market volatility resurges. The market will scrutinize every Fed communication for cut signals, creating a policy feedback loop.

Probability Assessment [per CME FedWatch; but INFERENCE with caveats]: December cut occurs on December 9–10 IF no CPI/PPI surprise higher; if data surprises, cut delayed to January 2026 (if delay if data is hot).

Falsifiable trigger: Core PCE rises to 3%+ YoY; producer prices surge >0.5% MoM in November/December.

4. Hyperscaler AI Debt Surge to $121B; Credit Spreads Widen

Alphabet, Meta, Amazon, Oracle, and Microsoft issued $121B in investment-grade bonds in 2025—4.3× the average annual issuance (2020–2024 = $28B/year)—to fund AI capex; corporate bond spreads widened 27–49%.

The debt wave began in September 2025 and accelerated through November (single-month November: $39.8B issuance—record). Drivers: (1) AI capex requires sustained multi-year commitments to data centers, GPUs, and power infrastructure; (2) all five firms have strong credit ratings and can access debt markets; (3) management rationale: lock in long-term funding while rates are available, front-load capex to secure GPU/TSMC supply chain capacity. Meta’s $27B Blue Owl Capital financing for Richland Parish data center and Amazon’s $15B bond issuance (Nov 17) exemplify scale.

However, credit market signals show stress: OAS (Option-Adjusted Spread) widened +48bp for Oracle, +15bp for Meta, and +10bp for Alphabet since September. This means investors demand higher yields to compensate for perceived incremental risk (capital intensity, uncertain ROI, duration risk if rates stay elevated). BofA analysts expect another $100B+ in 2026 issuance; if spreads continue widening, refinancing costs rise materially.

Impact: (1) Credit market: Investment-grade index likely to underperform if hyperscaler issuance accelerates further; basis widening (BBB-A spread compression) may occur as market reallocates to lower-duration assets. (2) Equity market: Analyst concerns about capex payback period dampen valuation multiples; mega-cap tech underperforms on valuation skepticism. (3) Leverage: While absolute leverage ratios stay low, the trajectory is upward; rating agencies may downgrade if leverage crosses thresholds (e.g., net debt/EBITDA moving from <1x to >2x). (4) Treasury curve: Longer-dated corporate issuance (10–30 year tranches) puts supply pressure on Treasury yields; corporate-Treasury basis may widen, signaling increasing credit risk premium.

Potential Policy Response: SEC may scrutinize disclosure of capex returns/assumptions; Treasury may raise issuance (to fund expanded gov’t spending) in competition with corporate supply, pushing both markets higher. No immediate regulatory caps, but ESG/SRI funds may reduce exposure to “cap-intensive tech,” fragmenting investor base.

Probability Assessment: At least one hyperscaler faces a credit downgrade or covenant pressure by mid-2026 if capex spending fails to generate margin expansion; if that occurs, refinancing costs spike by another 50–75bp.

Falsifiable trigger: S&P/Moody’s downgrades Oracle, Meta, or Amazon to BBB- by Q2 2026.

5. OpenAI’s $207B Funding Gap by 2030—Utility vs. SaaS Model Bifurcation

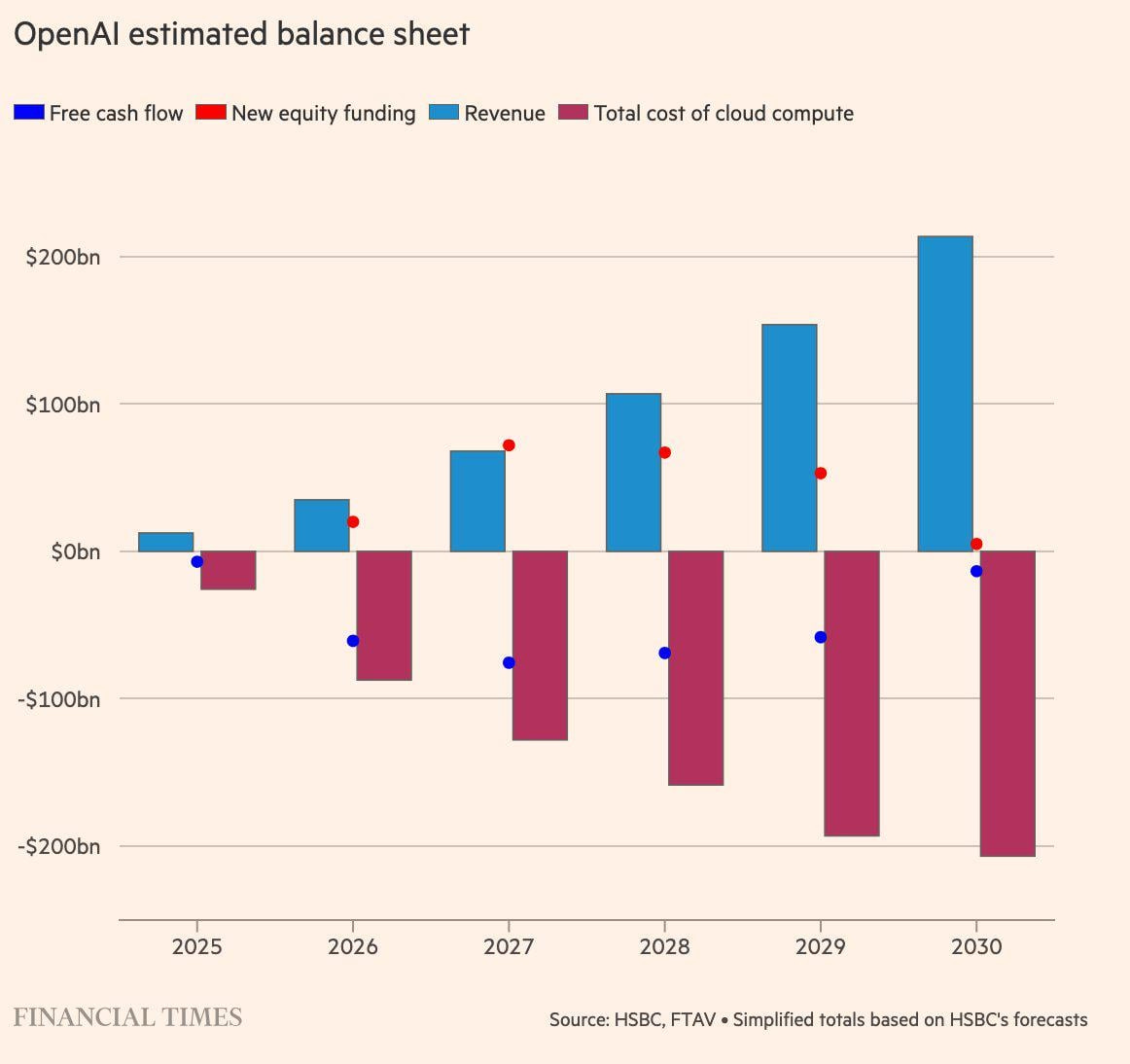

HSBC estimates OpenAI faces $207B capex shortfall by 2030 after committed cloud/compute spending ($588B) exceeds projected free cash flow ($282B), reframing AI companies as capital-intensive utilities rather than software businesses.

The insight is that OpenAI’s business model fundamentally differs from traditional SaaS: it requires upfront capex lock-in (pre-revenue compute commitments), extended payback periods (7–10 years), and high operational leverage (marginal cost per inference scales with capex, not variable cost). This resembles telecom, power utilities, or semiconductor fabs more than Salesforce or Adobe.

https://www.reddit.com/r/EconomyCharts/comments/1p7yt55/hsbc_built_a_model_to_figure_out_if_openai_can/

Key assumptions in the HSBC model: (1) OpenAI reaches 10% paid subscriber penetration by 2030 (~$6–8B annual recurring revenue estimate); (2) free cash flow defined as operating cash flow minus capex; (3) capex = $792B cumulative through 2030 (rents, not CapEx in traditional sense—mostly cloud service subscriptions). If conversion to paid stalls (geopolitical regulation, monopoly concerns, or user preference for free models), revenue falls short, and the gap widens to $300B+.

Mitigation pathways per HSBC: (a) raise paid subscriber % from 10% to 20% ($194B incremental revenue); (b) monetize advertising (YouTube-style); (c) achieve capex efficiencies (lower cost per FLOP); (d) partner/acquire cloud infrastructure (Microsoft, Oracle integration). None of these is guaranteed.

Impact: (1) Private equity/VC: OpenAI valuation multiples may face downward pressure if capex intensity becomes visible to LPs; future funding rounds dilute founders/early investors. (2) Cloud providers: AWS, Azure, Oracle Cloud become primary beneficiaries; margins expand as utilization rates spike from OpenAI lock-in. (3) Debt markets: If OpenAI seeks debt financing, pricing will reflect a capex-intensive utility profile; debt-to-EBITDA multiples spike; refinancing risk heightens. (4) Geopolitics: Large-scale US compute infrastructure concentrated in a few hands (OpenAI + Microsoft + Google + Meta) attracts regulatory scrutiny (antitrust, national security, energy security).

Potential Policy Response: US/EU regulators may mandate interoperability (e.g., compute access for competing AI models) or energy/supply-chain audits. Tax policy may shift (capex depreciation treatment, R&D credits). Strategic industries may receive subsidies (similar to the semiconductor CHIPS Act).

Probability Assessment: By 2027, OpenAI seeks $30–50B in external capital (equity or debt) from strategic investors (Saudi PIF, Abu Dhabi sovereign funds, or Microsoft/Oracle deeper integration); if valuation is below $100B (vs. current $200B+ rumors), major dilution ensues for existing shareholders.

Falsifiable trigger: OpenAI announces major capital raise or debt issuance by Q2 2026.

6. BlackRock IBIT Bitcoin ETF $2.2B November Redemptions; Crypto Risk-Off

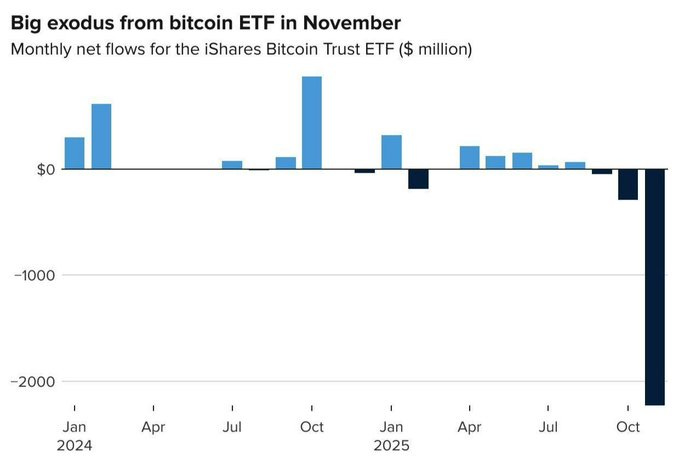

BlackRock’s iShares Bitcoin Trust (IBIT) recorded $2.2B in November outflows (62% of total spot BTC ETF redemptions); Bitcoin fell 30% from the October peak ($100K+) to $80K, marking the worst month since 2022.

https://x.com/EcoPulseStreet/status/1994769497606050288

November 2025 saw roughly $3.5B in total net outflows from US spot Bitcoin ETFs, nearly matching the February 2025 record of $3.6B. IBIT alone accounted for $2.2B of this ($523M in a single-day outflow on Nov. 19). The sell-off reflects broad risk-off sentiment (equity volatility spikes, rate-cut hopes wavered until late November, tariff uncertainty), combined with profit-taking after October’s all-time-high rally to $100K+.

Notably, the average purchase price across all spot BTC ETF buyers since January 2024 is $90,146 (per Bianco Research); at $80K spot price, many recent institutional buyers are underwater or at breakeven, spurring redemptions. Record trading volume ($11.5B on a single day) suggests both forced selling and tactical opportunistic buying, but net redemptions dominate, indicating that institutional conviction has weakened.

Impact: (1) Bitcoin price: Downward pressure; if IBIT redemptions accelerate, spot/futures basis widens (spot supply glut); arbitrage traders force spot prices lower to clear redemptions. (2) Crypto market structure: Institutional adoption thesis (Bitcoin ETF = gateway to mainstream) faces headwind; if redemptions persist, price may crack below $70K support, triggering forced selling from margin positions and further cascade. (3) Regulatory narrative: Crypto skeptics cite ETF redemptions as proof of fragility; pro-crypto advocates argue redemptions are normal (similar to bond ETF outflows in a rising-rate environment). (4) Altcoins: Typically trade with higher beta to Bitcoin; if BTC crashes, altcoins face 50%+ drawdowns (Ethereum, Solana, XRP).

Potential Policy Response: SEC/CFTC may scrutinize stablecoin backing and crypto lending (Celsius, FTX-like blowups); central banks may accelerate CBDC rollout to reduce retail dependency on volatile crypto.

Probability Assessment: Bitcoin drops to $60K–$70K range by end-Q1 2026 if macro backdrop remains uncertain (Fed cuts disappoint, tariffs escalate); if Bitcoin holds above $75K into December 2025, rebound to $110K+ possible by Q2 2026 (50/50 scenario).

Falsifiable trigger: BTC breaks below $75K support on weekly close; if it holds above, up/down scenario nearly equal.

7. Tether Gold Holdings Reach 116 Tonnes (Q3 2025); Non-Sovereign Central Bank Equivalence

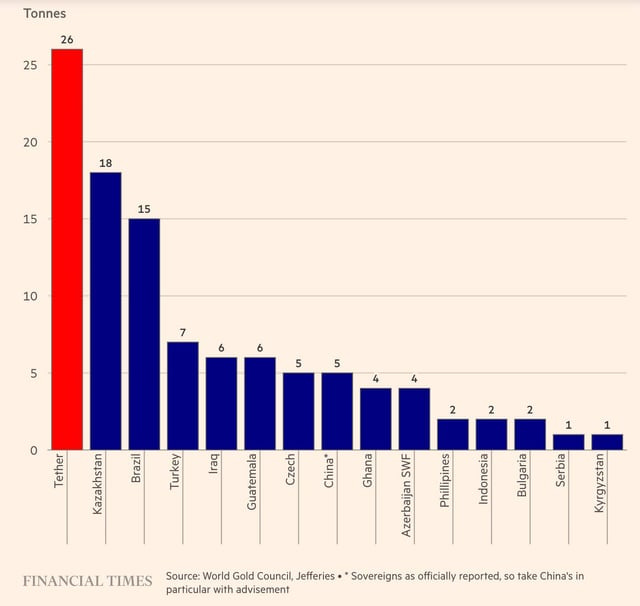

Stablecoin issuer Tether purchased ~26 tonnes of gold in Q3 2025 alone, bringing total holdings to 116 tonnes—ranking among the top 30 sovereign central bank reserves globally and representing 7% of USDT reserves.

https://www.reddit.com/r/EconomyCharts/comments/1p75ci8/tether_bought_more_gold_last_quarter_than_every/

Jefferies’ report (published late November 2025) detailed Tether’s aggressive bullion acquisition, noting that Q3 2025 alone accounted for ~2% of global gold demand. The vast majority (104 tonnes) backs USDT reserves; 12 tonnes back the tokenized gold product XAUT (market cap ~$1.5B). Tether CEO Paolo Ardoino projected $15B in 2025 profit, and the firm signaled continued gold buying (possibly 60+ tonnes annually if half profits deployed to bullion).

Tether’s gold purchases are a form of non-state capital flowing into gold at a scale previously reserved for central banks or large hedge funds (e.g., China, Russia, Saudi PIF). This affects spot gold supply/demand dynamics: a concentrated private buyer can tighten near-term supply and influence price sentiment. Jefferies links recent gold price rallies (surged >50% YoY, now ~$4,080/oz) partly to Tether buying.

Interestingly, Tether is now hiring ex-HSBC metals traders and has invested $300M+ in gold royalty/streaming companies, suggesting a broader commodity strategy (not just reserve backing, but trading/positioning).

Impact: (1) Gold market structure: Reduced float available for physical delivery (central bank buys, now corporate buys); retail and speculative positions face tighter liquidity and wider bid-ask spreads. (2) Central banks: ECB, Bank of England, Fed, Bank of Japan all hold massive gold reserves; if Tether accumulation accelerates, it competes for the limited supply, potentially supporting prices. (3) Reserve asset strategy: Tether’s move to gold (alongside Bitcoin) signals a hedge against fiat currency debasement; other stablecoins/private financial vehicles may copy, fragmenting reserve-asset preferences. (4) Geopolitics: A Private non-state actor holding more gold than many central banks raises sovereignty/regulatory concerns (e.g., if Tether is sanctioned, would gold be frozen?).

Potential Policy Response: SEC/Treasury may scrutinize stablecoin reserve composition and physical storage (Basel III gold capital treatment); potential regulation mandating reporting of large private gold holdings (>50 tonnes) similar to CFTC Commitment of Traders.

Probability Assessment: Tether continues accumulating at 40–60 tonnes/year through 2027; if the crypto bull market persists, the USDT market cap expands to $20–25B, and gold backing grows proportionally. If crypto crashes 60%, the USDT market cap shrinks, and gold accumulation pauses.

Falsifiable trigger: USDT market cap drops below $10B or Tether announces profit miss (guidance <$10B).

8. Indian Rupee at Record Low 89.48/$1; RBI Reserves Drained $38B Since July

Indian rupee weakened to an all-time low of 89.48 per USD on November 21, 2025; RBI sold ~$38B of forex reserves since the end of July to defend the currency amid US tariff threats and FPI outflows.

Analysis: The rupee’s 2025 weakness is driven by: (1) US tariff threats on Indian imports (50% tariffs proposed); (2) foreign portfolio investor (FPI) outflows (~$3–5B net outflows September–November); (3) current account deficit widening from trade/oil imports; (4) strong US dollar (DXY ~106). The RBI has intervened extensively—selling dollars in the spot market and building large short positions in the offshore non-deliverable forwards (NDF) market (~$88.7B short positions at peak in February 2025, gradually unwound).

However, intervention has limits: RBI’s total forex reserves stand at ~$600–620B (as of late 2025), sufficient to absorb $38B over 4 months, but depletion accelerates if pressures persist. The Finance Ministry stated the depreciation is “in line with EM currency trends” and reflects “global factors” (US rates, dollar strength), but acknowledgement of the RBI’s role is implicit.

Impact: (1) Import costs: INR weakness raises the cost of oil, electrical equipment, and electronics imports; inflationary pressure on India’s 1.4B population and corporate margins. (2) Corporate debt: Foreign-currency-denominated debt servicing becomes more expensive (1% rupee depreciation = ~2–3% capex hit for exporters with hedged positions). (3) Reserve adequacy: RBI’s forex reserve ratio (to short-term external debt) remains solid at ~8–10x, but depletion pace warrants monitoring; if it accelerates to $50B+/year, adequacy slides. (4) Monetary policy: RBI faces conflict between defending the rupee (sell reserves, raise rates) and supporting growth (cut rates, allow depreciation); likely to opt for depreciation tolerance + selective intervention.

Potential Policy Response: RBI may seek new swap lines with other central banks or explore rupee internationalization (local-currency trade settlement with BRICS/neighbors). The government may impose capital controls or lower gold import tariffs (encourage remittances in gold vs. FX).

Probability Assessment: Rupee stabilizes in 88–89/$1 band through 2026 if tariffs are not further escalated; if Trump tariffs exceed 50% or escalate to full 25% across-the-board, rupee could drift to 92–94/$1 by Q2 2026.

Falsifiable trigger: USD/INR breaks above 90; if it holds below 90, mean reversion toward 86–88 likely by Q2 2026.

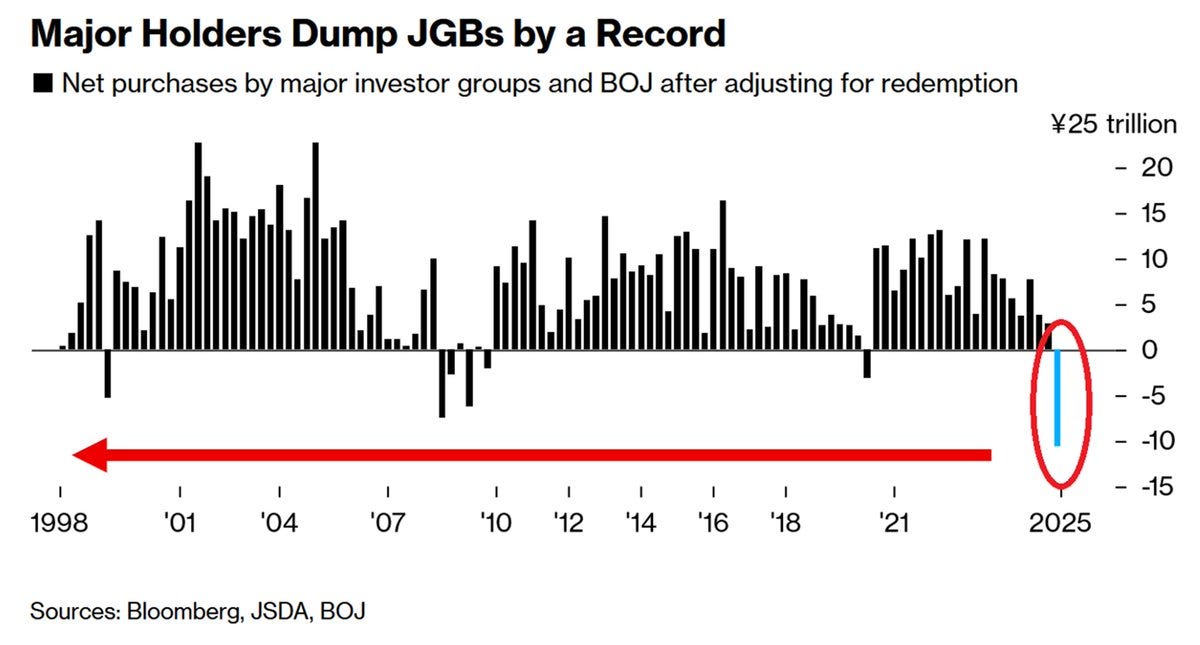

9. Japan JGB Foreign Investor Selloff; Yields at 17-Year Highs

Foreign investors offloaded 2 trillion yen (~$13.6B) of long-term JGBs in the week through September 27, 2025—the largest weekly selloff in a year—as 10-year yields surged to 1.665% (17-year high) on Bank of Japan rate-hike expectations.

Japan’s bond market repricing reflects: (1) BoJ board split over timing of rate hikes (two board members voted for immediate hikes at Sept 18–19 meeting); (2) fiscal concerns post-resignation of Prime Minister Ishiba (dovish on fiscal discipline); (3) foreign investors’ reassessment of term premium—30-year JGBs at 1.028% earlier, now pushing higher, representing real yield compression post-inflation. Domestic investors (banks, life insurers) have been net buyers of super-long JGBs (30-year purchases reached 2.3T yen in April alone); foreign participation turned negative as BoJ tightening scenarios materialized.

https://x.com/GlobalMktObserv/status/1994036992162607366

The 17-year high in 10-year yields is significant: it signals the end of the ultra-low-yield era for Japan and potential spillovers into global rates (if Japanese demand for foreign bonds weakens, yen must weaken, pressuring carry trade unwinds).

Impact: (1) Japanese financials: Banks’ net interest margins (NIMs) expand as deposit rates lag lending rate hikes; insurance companies face mark-to-market losses on existing JGB portfolios. (2) Japanese corporates: Refinancing costs rise; CapEx-sensitive firms (auto, electronics) face margin pressure. (3) Currency: If BoJ follows through with rate hikes, the yen strengthens; carry trades funded in JPY unwind, potentially cascading into equity/commodity selloffs in USD/EUR/GBP. (4) Global rates: If Japanese yields rise faster than expected, it signals EM tightening globally; US Treasuries may see upward pressure as portfolio rebalancing occurs.

Potential Policy Response: BoJ may telegraph gradualism (slow hike path) to avoid market shock; the Japanese government may announce fiscal tightening measures to address fiscal concerns raised by foreign investors.

Probability Assessment: BoJ delivers 25bp hike by end-2025 or Q1 2026 (not immediate); if hike is delayed beyond Q1 2026, JGB yields stabilize 1.2–1.4% (currently 1.665%); if hike occurs on schedule, yields could spike to 2%+ and yen strengthens to 135–140/$USD (vs. current 145–155).

Falsifiable trigger: BoJ delays rate hike beyond March 2026 or signals pause; if confirmed, 10-year JGB yields drop 50–75bp into 1.1% range.

10. Micron $9.6B HBM Fab Investment in Hiroshima; 2028 Production Ramp

Micron Technology announced an investment of ¥1.5 trillion (~$9.6B) to build an advanced high-bandwidth memory (HBM) manufacturing facility in Hiroshima, Japan, with production targeted for 2028, supported by a ¥500B Japanese government subsidy.

Micron’s move is a strategic diversification away from Taiwan (geopolitical risk) and toward Japan (government support, supply-chain resilience). HBM is critical for AI accelerators (NVIDIA H200, etc.); current supply is constrained (SK Hynix and Samsung are primary suppliers), and demand has surged as hyperscalers deploy AI training clusters. Micron’s entry will add capacity and reduce concentration risk, but production ramp is 2028—meaning HBM supply shortages and price premiums likely persist through 2027.

The Japanese government subsidy is part of a larger ¥5.7T chip-revival initiative launched in 2021; additional ¥252.5B earmarked in the new budget for AI/semiconductor support. This reflects the Japanese desire to regain semiconductor independence (lost since the 1990s to TSMC/Samsung dominance).

Impact: (1) AI capex costs: 2028–2030 onward, HBM prices likely decline 15–25% as Micron ramps; reduces total cost of ownership for hyperscale data centers ($5–10M per petaflop saved). (2) SK Hynix/Samsung margins: Near-term protected (pricing power through 2027); 2028+ face margin compression as Micron supply comes online. (3) NVIDIA/AI chip complexity: Easier HBM sourcing reduces supply-chain fragility; enables faster adoption of next-generation accelerators. (4) Geopolitics: Japan’s move strengthens semiconductor supply-chain resilience for democratic nations; China’s supply isolation extends.

Potential Policy Response: Taiwan/Korea may accelerate HBM expansions to compete; the US may subsidize domestic HBM capacity (similar to the CHIPS Act); China may accelerate state-backed HBM R&D (likely years behind due to export controls).

Probability Assessment: Micron’s Hiroshima fab reaches 50% production capacity by 2029; by 2030, meaningful HBM supply competition emerges, triggering price compression and margin-related analyst downgrades for SK Hynix/Samsung.

Falsifiable trigger: Micron misses 2028 production timeline (pushes to 2029+) or yields below 60%; if timeline slips, HBM premiums persist longer.

11. Goldman Sachs Panic Index Approaches Mid-Cycle Extremes; Options Hedging Demand Surges

Goldman Sachs’ internal volatility panic gauge (0–10 scale) stood at 5 as of late November, having peaked near 9.6 earlier in the month. Paired with a 50% surge in the VIX to 26.3, record out-of-the-money put purchases, and skewed option pricing, the market has re-priced tail-risk expectations sharply upward after six months of tight range-trading.

For five years, the USD and VIX exhibited a positive correlation: equity panic drove dollar strength as a safe-haven trade. Starting January 2025, that relationship inverted—a risk-off event now tends to weigh on the dollar. This decoupling, noted by Goldman strategists, suggests a structural shift in carry-trade unwinding patterns and reserve accumulation dynamics. The November spike in the VIX, despite record tech earnings, reflects three linked pressures: (i) overextended equity valuations (S&P 500 P/E multiples in top quintile relative to 20-year history), (ii) Fed signaling a pause in rate cuts, creating duration re-risk, and (iii) concentration: seven tech mega-caps account for ~30% of index weight, amplifying momentum reversals. Historical data from Sahm Capital showed that in prior 50%+ VIX monthly spikes (Oct 2008, Feb 2020, Aug 2015), average 12-month forward returns were +9.49%, but with high variance—40% of cases saw negative 1-month returns.

Impact & Policy Implications: Elevated volatility will increase hedging costs for institutional portfolios, particularly those with embedded leverage or short duration exposure. Banks and prime brokers face higher margin calls, potentially triggering cascading deleveraging if liquidity conditions tighten during Treasury settlement windows. The Fed will likely interpret persistent VIX elevation as a signal to remain data-dependent rather than pre-commit to further cuts; this shifts the probability of a 2026 rate-cut cycle from ~70% (market pricing, mid-November) to ~55% (current consensus post-panic). Affected parties: long-duration fixed-income holders, leveraged equity funds, and commodity-linked carry strategies.

Probability Assessment: VIX normalizes to the 15–18 range within 6 weeks; a new panic spike (>30) occurs within 12 months if geopolitical or earnings surprise materializes.

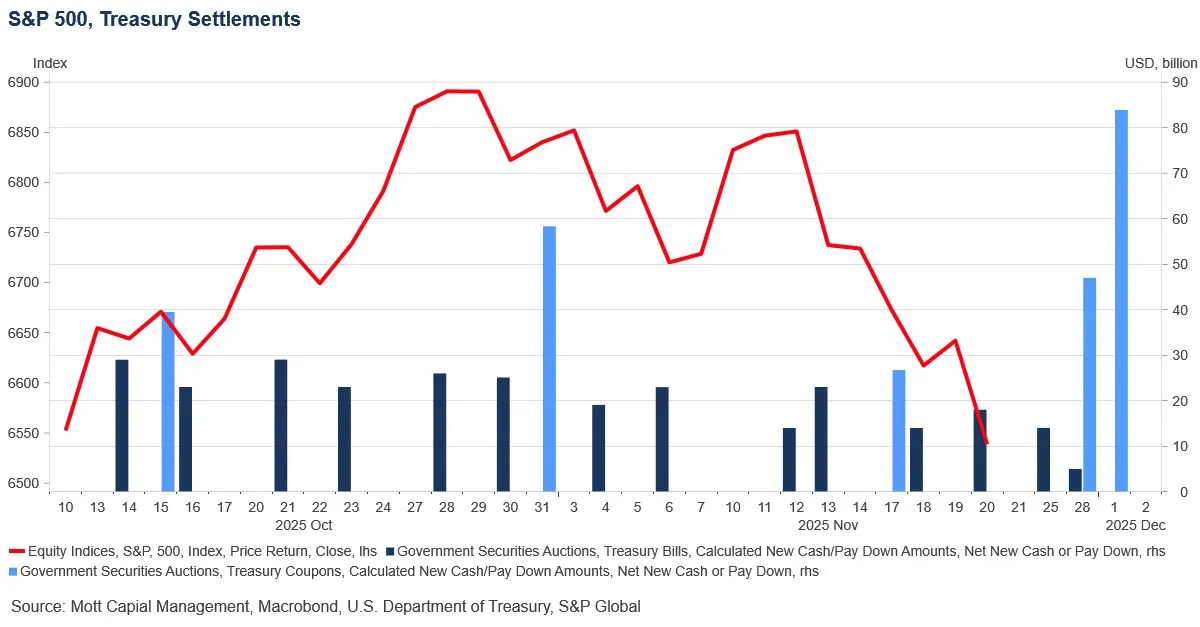

12. US Treasury Settlement Squeeze: ~$150B Liquidity Drain Over 6-Week Window

The US Treasury’s auction and settlement schedule concentrates ~$150B of bond issuance, and repayment flows across key dates (11/25, 11/28, 12/1, 12/15–18, 12/23–26, and into January 2026). Combined with thin holiday-season trading, year-end bank balance-sheet tightening, and reduced repo liquidity from systematic risk limits, short-term funding markets face acute strain.

Treasury refinancing typically creates a temporary negative supply shock. However, the Dec 2025 calendar is extreme: 4-week bills, 8-week bills, nominal coupons (1Y–30Y tenor spread), and TIPS settle across Thanksgiving and Christmas periods—traditionally the lowest-volume trading windows. Historical precedent: December 2019 saw repo rates spike to 10%+ on a funding crunch; December 2024 saw similar pressure, with 1-month SOFR averaging 5.3% mid-month. Market data shows cumulative settlement obligations of $6.7B in 4-week bills, $4B in 8-week bills, plus rolling buyback operations. Estimate of net cash drain: $120–180B depending on auction concession and dealer inventory absorption.

Impact & Policy Implications: Short-term repo rates could spike 50–100 basis points above the Fed funds rate, raising carry costs and potentially triggering forced asset sales if leveraged portfolios breach collateral thresholds. Treasury curve could flatten (long-end yields may ease as dealer demand contracts) while short-end rates rise. The Fed may need to inject liquidity through a standing reverse repo or signal willingness to tolerate higher overnight rates. For traders: elevated carry risks on T-bill positions; wider bid-ask spreads on off-the-run issues expected through early January. Corporate bond issuance likely to stall; equity volatility may overshoot on liquidity concerns unrelated to fundamentals.

Probability Assessment: T-bill yields exceed 5.50% at some point in December; repo stress forces the Fed to intervene with emergency liquidity measures.

13. NVIDIA Q3 Record Revenue & Inventory Puzzle: Signal or Noise?

NVIDIA reported record Q3 revenue of $57.0B (Data Center $51.2B) on Nov 19, 2025, while inventory rose ~32% q/q — a dynamic that could reflect WIP buildup for Blackwell production or early signs of demand timing mismatches. Analysts are split between a benign “strategic buffer” view and a cautious “forward demand cliff” scenario.

NVIDIA’s gross margin remained strong at 74.6%, though down slightly from 75.1% in Q2, consistent with a mix shift toward higher-complexity H200/Blackwell systems (lower immediate margin but higher ASP and longer lifecycle value). The company’s Q4 guidance of $37.5B (±2%) revenue implies continued momentum, though slightly below the prior quarter’s growth rate (suggesting potential moderation). Inventory semantics matter: the 32% QoQ increase includes raw materials, work-in-progress, and finished goods. In a scenario of accelerating AI capex cycles (cloud providers expanding inference clusters), such a buffer is rational. However, NVIDIA’s customer concentration reached 61% (top 4 clients) in Q3, up from 56% in Q2—a red flag for revenue persistence risk if any major hyperscaler curtails purchases or redirects to in-house silicon (e.g., Google’s TPU, Meta’s MTIA). Forward risks: (i) demand plateau if gen-AI productivity gains fail to materialize (currently inciting R&D skepticism), or (ii) accelerated competitive offerings from AMD Instinct or custom ASICs displacing share.

Impact & Policy Implications: If inventory turns out to be precautionary and demand sustains, NVIDIA stock likely trades higher on confidence recovery; if inventory normalizes poorly, earnings miss likely in Q1–Q2 2026, triggering tech sector repricing. For portfolio managers: overweight tech positions should consider hedging with OTM puts; for supply-chain operators, anticipate potential price wars in GPU margins in 2026 if inventory needs to clear. Regulatory: China’s rising self-sufficiency in AI chips will eventually constrain NVIDIA’s addressable market in lower-tier applications, though near-term upside from inference demand remains strong.

Probability Assessment: inventory normalizes gracefully, and Q4–Q1 revenue meets guidance; Customer concentration pressures forecastability, leading to a miss by >5% in FY2026.

14. Oil Markets: OPEC+ Pause Signals Caution, but Structural Surplus Looms

Brent crude traded near $62.38/bbl as of late November, down 17% YoY and near a four-month low. OPEC+ has signaled a pause on production increases beyond December, with members expected to hold output flat in Q1 2026. However, global oil inventories are projected to build by 2–4M bpd on average in 2026 (vs. 1.9M bpd in 2025), creating structural downward pressure. EIA forecasts Brent to average $62.23/bbl in 2026, with Q1 averaging potentially as low as $55–58/bbl.

The four-month price decline reflects: (i) soft global demand (China stimulus offsetting geopolitical Mideast premiums), (ii) rising non-OPEC supply (US shale, Brazil pre-salt, Guyana ramp), and (iii) market skepticism on OPEC+ compliance. Futures markets embed 40%+ backwardation to Q1 2026 futures, indicating the trading community’s conviction on near-term surplus. Russia’s continued oil exports (~2.5M bpd, despite Western price caps) and Saudi Arabia’s announced price cuts for Asian customers (lowest in 5 years) suggest producers are bracing for a prolonged low-price environment. Geopolitical tail risk: any reduction in Ukrainian exports or Iran sanctions relief could tighten supplies and lift Brent $5–10/bbl. Conversely, if Ukraine peace talks accelerate, the market could price in Russian supply reintegration, pushing Brent below $55/bbl.

Impact & Policy Implications: Upstream oil & gas companies face earnings compression; integrated supermajors (ExxonMobil, Shell ) may cut capex and dividends. Energy-exporting sovereigns (Saudi Arabia, Russia, Nigeria, Ecuador) face fiscal pressure; geopolitical risk of OPEC+ fraying if members exhaust compliance incentives. OPEC+ likely to impose production cuts by H2 2026 if prices breach $55/bbl floor. For traders: long-dated oil calls (2026–2027 expiry) are underpriced; tactical shorts on WTI 2-month futures offer asymmetric risk/reward into the OPEC+ Jan meeting.

Probability Assessment: Brent averages $55–62/bbl in 2026; OPEC+ implements unilateral production cuts by mid-2026 if prices persist below $60/bbl.

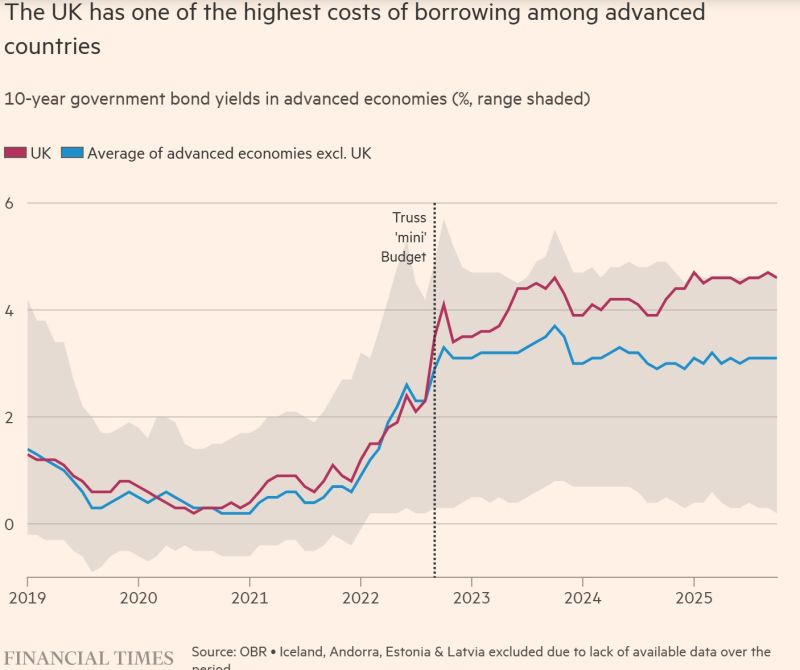

15. UK Autumn Budget: Short-Term Fiscal Relief, Long-Term Sustainability Questions

Chancellor Rachel Reeves unveiled the UK Autumn Budget on November 26, 2025, delivering a package that includes tax increases (£17–20B estimated over 5 years) aimed at restoring fiscal credibility. The Office for Budget Responsibility (OBR) raised its forecast headroom to nearly £22B (5-year estimate), up from prior expectations of £10–17B. Market reaction was initially positive: gilt yields fell 11 basis points (30Y) to 5.22% by late trading, sterling recovered, and the FTSE 100 gained 57 points.

The budget hinges on three pillars: (i) freezing personal income tax thresholds through 2028 (fiscal drag yielding ~£8B/year), (ii) pension tax relief caps and salary sacrifice restrictions (~£2B/year), and (iii) selective business taxes (Council Tax surcharge for homes >£2M, expanded NICs). However, underlying fiscal dynamics remain challenging. Bank of England QT (quantitative tightening) has raised 10-year gilt yields by an estimated 25–30 basis points independently of budget measures (per Costas Milas, University of Liverpool). Current 30-year gilt yields at 5.22% remain the highest among G7 nations, partly reflecting the BoE’s aggressive asset unwinding ($100B+ per annum). The structural deficit—output gap vs. potential implies that even with new revenue measures, medium-term fiscal consolidation remains dependent on either (i) growth acceleration (consensus 1.5–2.0% CAGR, below pre-2008 trends), or (ii) further spending cuts.

https://www.linkedin.com/posts/mohamedelerian_economy-markets-debt-activity-7399856994385416192-dFbM/

Impact & Policy Implications: Gilt investors face duration risk if the BoE signals further rate cuts; investors face bracket creep and capital gains tax (some relief measures, but savings ISA limit cut from £20K to £12K pressures household savings). Growth stocks and small-cap indices may underperform due to a higher tax burden on investment income. UK corporate earnings could face margin compression if wage inflation (from NIC pressure) passes through. For GBP: near-term rally likely if BoE data dependency reassures (vs. recession risk), but medium-term weakness if OBR growth forecasts prove optimistic.

Probability Assessment: UK 10Y yield remains in the 4.2–4.7% range through 2026; OBR growth forecasts prove optimistic, and fiscal consolidation requires additional measures by 2027.

16. Consumer Spending Resilience: Black Friday Record & Retail Margin Compression

US online consumers spent a record $11.8B on Black Friday 2025 (+9.1% YoY), with projections for Cyber Week (Thanksgiving through Cyber Monday) reaching $43.7B (+6.3% YoY). Adobe Analytics data confirms strong consumer participation despite macroeconomic uncertainty, though category-level data reveals aggressive discounting.

Black Friday 2025 dynamics show: (i) outsized discounts (electronics -29%, toys -28%, apparel -25%, TVs -24%), (ii) mobile-first purchasing (58.6% of sales, +11.3% YoY), (iii) AI-assisted shopping surge (600% higher AI traffic to retail sites vs. prior year), and (iv) BNPL (Buy-Now-Pay-Later) growth to $761.8M Friday spending (+11% YoY). These patterns signal price-sensitivity and extended payment demand among consumers—classic precursors to margin compression in Q4–Q1 retail earnings. However, the aggregate spending growth (+9.1%) outpaced volume growth (Salesforce data showing -2% item count, -1% order volume), implying higher average selling prices (ASPs +7%) despite markdowns. This mixed signal suggests: consumers prioritize quality/discretionary goods (video game consoles, electronics, home appliances) but negotiate harder on price; retail margins are under pressure but offset by higher per-transaction value.

Impact & Policy Implications: Retailers (Target, Walmart, Amazon, Best Buy ) will report solid top-line growth but margin compression in Q4 2025 earnings (January–February release). Apparel/discretionary goods manufacturers face near-term pricing pressure; logistics providers (XPO Logistics, J.B. Hunt ) likely benefit from volume surge. Consumer confidence may hold above 95 through early 2026, supporting economic growth narratives.

Probability Assessment: Q4 2025 retail sales growth meets 5–7% forecast; Q1 2026 retail margins compress 100–150 basis points due to post-holiday inventory clearance.

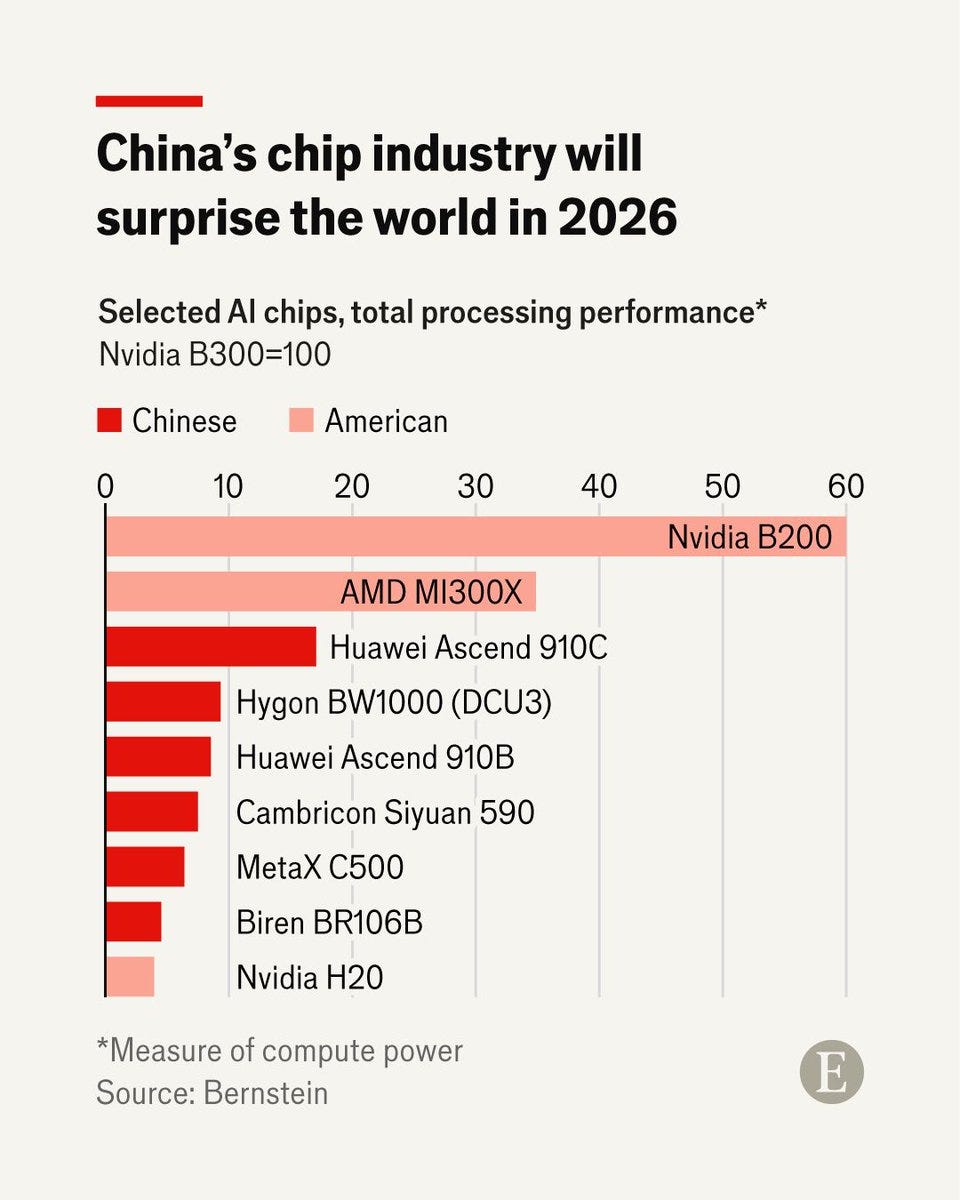

17. China’s Semiconductor Self-Sufficiency Push: 2026–2027 Inflection Point

China’s semiconductor industry, backed by state funding (>$8.4B invested in 2025 alone), is targeting a tripling of domestic AI chip output by 2026 with 82% chip self-sufficiency by 2027. Companies like Alibaba (testing next-gen AI processors on domestic foundries vs. TSMC), MetaX (unveiled Nvidia H20 alternative in July), and ChangXin Memory (preparing HBM3 mass production in 2026) are advancing rapidly. Chinese automakers (BYD, Li Auto, Geely, Changan) plan to achieve 100% domestic automotive chip content by 2027.

https://x.com/IshanTanna1/status/1994001625439195158

The self-sufficiency drive is constrained by: (i) lack of cutting-edge lithography equipment (<7nm node access remains limited due to export controls on ASML EUV machines), (ii) lower yields at advanced nodes, and (iii) architectural complexity. However, Chinese strategists are circumventing these limits via: (i) optimizing existing 14nm and 7nm nodes for AI applications (software/system-level enhancements reducing process dependency), (ii) vertical integration (in-house design + local foundries like SMIC), and (iii) government long-term contracting ensuring demand pull. Morgan Stanley projects 70% of data-center chip demand in China will be served by local products by 2027, vs. ~10–15% today. This reshapes global supply: NVIDIA and AMD will face market-share erosion in China and lower-tier export markets (Southeast Asia, India) as Chinese alternatives become price-competitive; conversely, ultra-advanced nodes (3nm+) and specialty segments (HBM, analog) remain US/Taiwan-dominant.

Impact & Policy Implications: NVIDIA and AMD guidance should increasingly exclude or downwardly bias China revenue contributions; equity analysts will likely apply a “China haircut” discount (10–20% revenue reduction) to semiconductor companies by 2027. Supply-chain companies (ASML, Tokyo Electron, Applied Materials ) may face export restrictions on advanced equipment, but mid-node equipment sales to China are stable. Long-term: geopolitical risk premium on chip stocks rises; diversification strategies (nearshoring to Vietnam, India) accelerate.

Probability Assessment: China achieves 60–75% domestic chip self-sufficiency by 2027; NVIDIA China revenue share (currently ~25–30% of total) compresses to 15–20% by 2028–2029.

The week recomposed risk premia — infrastructure and operational shocks (CME, Airbus) temporarily overrode macro narratives, but policy (Fed odds, UK budget) shaped medium-term positioning. Treat headline-driven volatility as a regime that widens spreads and favors convex, liquidity-sensitive trades.

If you’d like to show your appreciation, you can support me through:

✨ Patreon

✨ Ko-fi

✨ BuyMeACoffee

Every contribution, big or small, fuels my creativity and means the world to me. Thank you for being a part of this journey!