Who Controls the Rules, Controls the Returns

Inside the hidden information pyramid that turns rhetoric into real money.

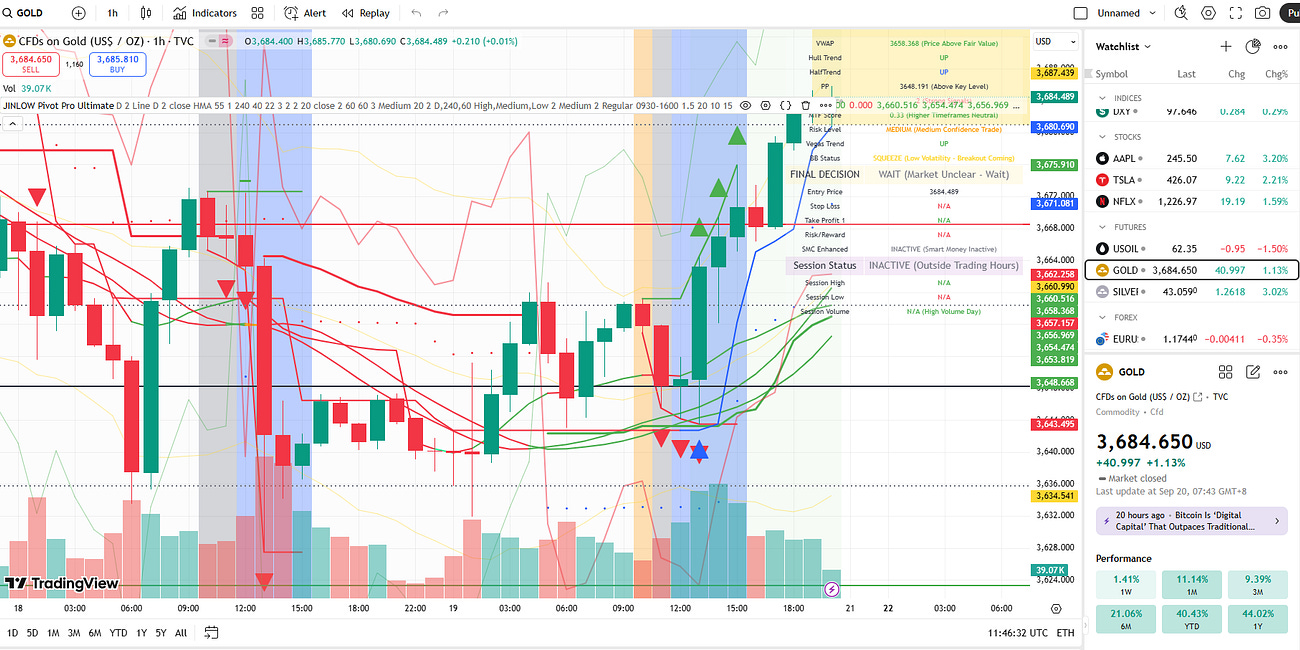

Political and market shocks are converging. This week’s (10/5-10/10) US federal shutdown, escalating tariffs on Chinese goods, and OPEC+ output decisions expose the fragility of a dollar-centred order. Fiscal paralysis and mass furloughs amplify policy risk and erode confidence in dollar liabilities; trade weaponization accelerates capital flight from equities into hard assets. Oil’s moves — driven by geopolitics and demand concerns — and a falling US rig count underscore shifting supply dynamics. Gold topping and then correcting around $4,000 signals a structural hedging impulse.

My premium members get the playbook before the market opens. They don’t guess. They know.

Introduction

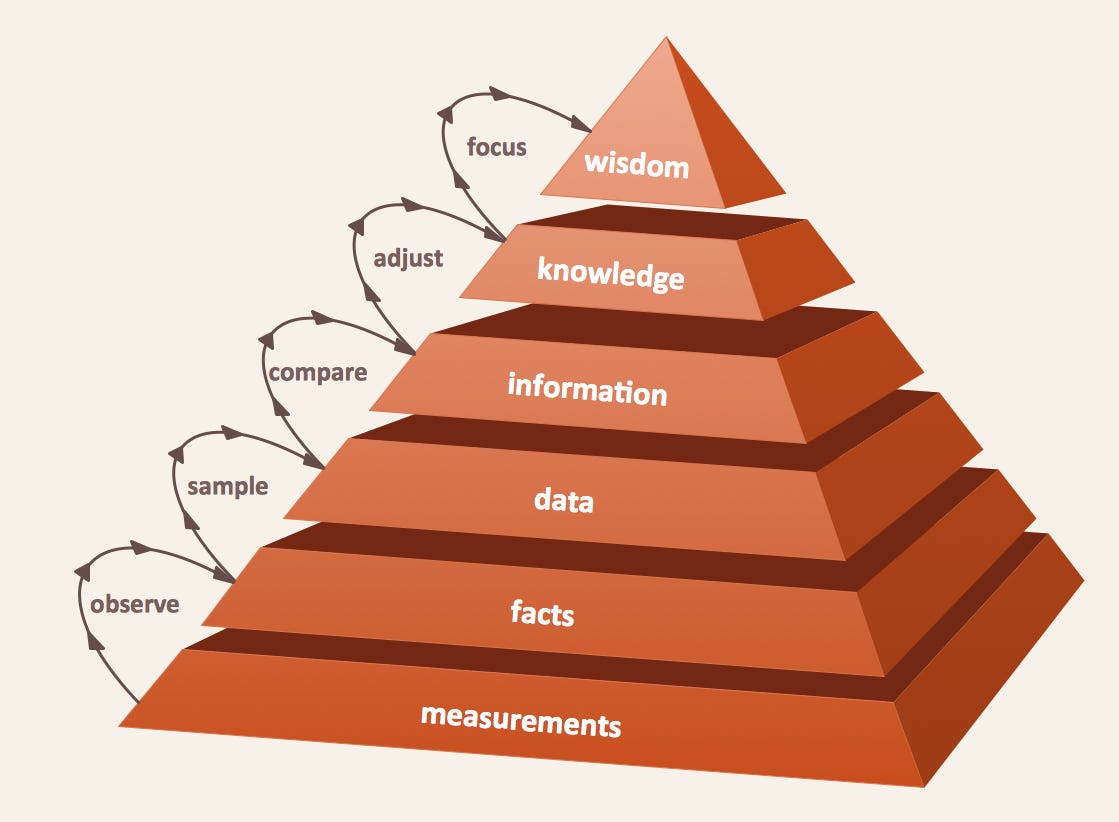

The market isn’t just about charts and data; more crucial is who has the power to translate the “rules” into a language the market understands. Many are led by candlestick charts, financial reports, and GDP figures, forgetting the true purpose of power: transforming a policy statement or an administrative hint into a concrete valuation model and position decision. Those who can interpret and quantify the rules are often the first to adjust their positions, hedge, and seize opportunities. Those who lag are tragically forced to follow the market’s rewritten rules.

When “One Person’s Words” Can Shift Markets

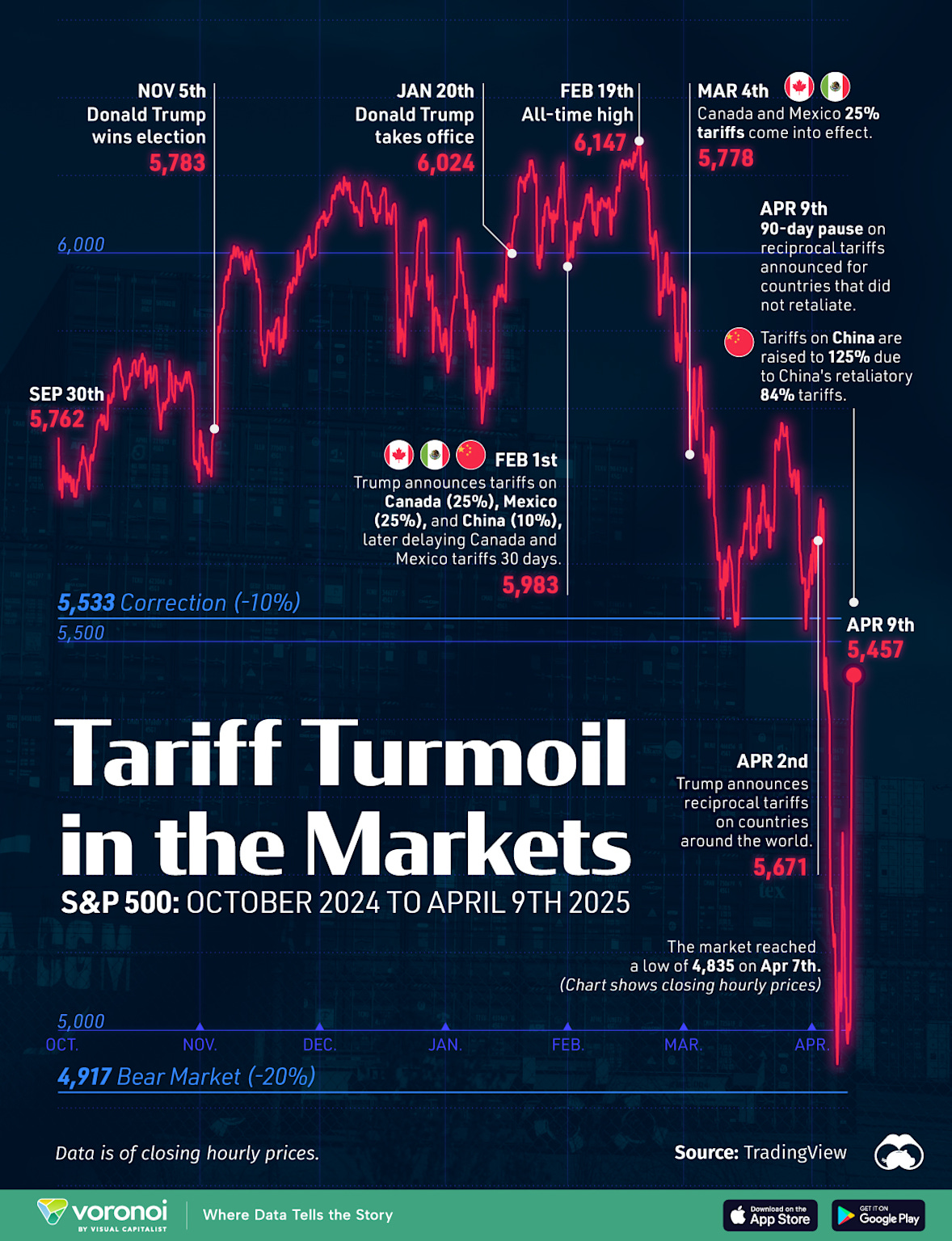

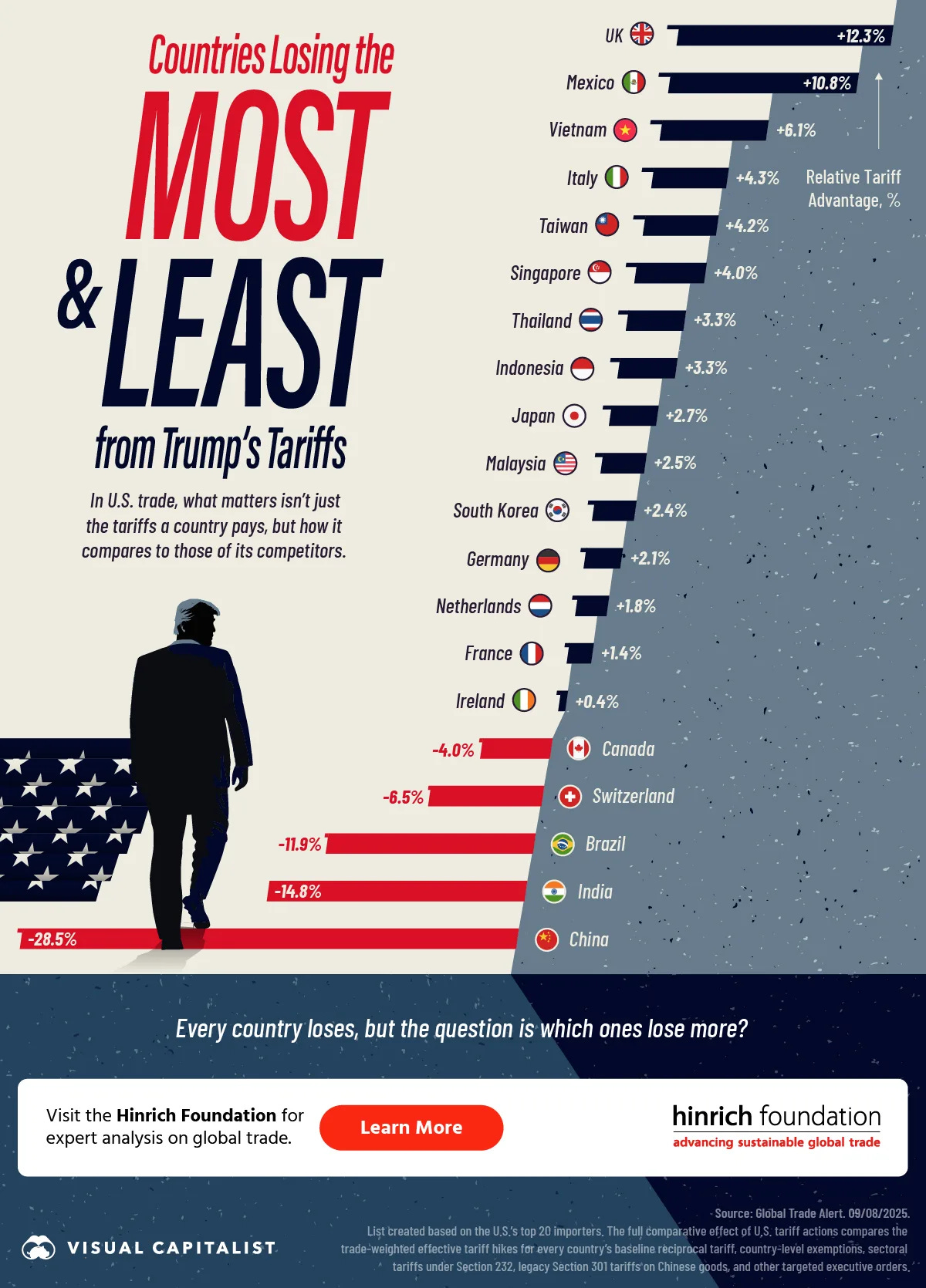

Markets are driven not only by prices but also by “who has the power to interpret rules.” This month provided a vivid example: Trump’s single statement about China tariffs instantly reordered market risk appetite and liquidity before any law was passed—a perfect illustration of how rule interpretation power serves as an asset pricing amplifier.

In an era of highly commoditized information, those who can issue rule signals and interpret rules first can rapidly shift expectations and capital flows within short timeframes. As traders, failing to incorporate “rule interpretation power” into our judgment means handing over risks and opportunities to others. This month’s public statements from Trump regarding China tariffs served as a masterclass in how policy signals cascade through different layers of society, each interpreting and acting upon the same information through vastly different lenses. The result is not merely market volatility, but a systematic redistribution of wealth that occurs the moment information travels from rule-makers to rule-takers.

https://www.visualcapitalist.com/charted-the-sp-500s-trump-driven-tariff-turbulence/

https://www.visualcapitalist.com/sp/hf08-ranked-countries-losing-the-most-and-least-from-trumps-tariffs/

The Information Hierarchy: Who Sees What, When

What happens when a single political statement instantly erases $2 trillion from market capitalization? How does a Truth Social post about rare earth minerals transform into nationwide investment decisions within minutes? These questions expose the architecture of modern information asymmetry—where the distance between policy signals and market execution determines who profits and who pays.

Three distinct groups received the same message, yet their worlds looked entirely different. This isn’t a coincidence—it’s the fundamental architecture of how power operates in modern markets.

Layer One: Rule-Makers—The Orchestrators of Strategic Ambiguity

Rule-makers occupy the apex of this information pyramid. They don’t just receive information; they create it. When Trump’s administration leaked hints about “massive tariffs” before the official announcement, certain circles already knew what was coming.

The fascinating dynamic here is how rule-makers calculate. They’re not primarily concerned with economic efficiency but with political returns versus economic costs. Trump’s tariff threats serve multiple masters simultaneously: they shore up domestic political support, provide negotiating leverage with China, and allow real-time market testing of policy proposals. The morning after the announcement, when markets plunged 2.7%, administration officials were already preparing “clarifying statements” to moderate the impact. This isn’t policy failure—it’s policy by design.

Who They Are

Presidents, senior White House staff, policy teams, major lobbying groups, and key think tanks—those who possess what we might call “interpretive authority” over regulatory signals.

How They Read

Rule-makers treat verbal statements as calibrated political instruments rather than spontaneous remarks. Every element carries measurable information: tone, timing, and accompanying terminology like “immediate” or “take action”. They parse the difference between market testing and policy commitment.

Their Judgment Logic

Political calculation precedes economic optimization. They prioritize electoral consolidation, negotiating leverage, and diplomatic pressure over pure economic efficiency. Verbal threats serve as “market laboratories”—allowing them to gauge reaction before committing to formal implementation.

Their Actions

Immediate: Monitor market response and stakeholder feedback, prepare “clarification statements” or “exemption lists” to control spillover effects

Medium-term: If pursuing implementation, initiate administrative paperwork, draft tariff schedules, and enforcement timelines

Strategic: Maintain deliberate ambiguity—preserving both deterrent effect and retreat options

Trader/Information Worker Checklist:

Establish primary alert systems for high-level channels (White House statements, presidential social media)

Focus on “tone” over literal content; track subsequent clarifications and exemption signals as critical inflection points

Layer Two: Managers—Converting Possibilities into Balance Sheets

Managers form the critical middle layer where abstract threats become concrete costs. Corporate executives, compliance officers, risk managers, and institutional investors don’t have the luxury of strategic ambiguity. When they hear “100% tariffs,” they must immediately begin modeling supply chain disruptions, contract renegotiations, and operational adjustments. Their response is fundamentally conservative: prepare for the worst-case scenario while hoping for the best.

This precautionary logic creates a peculiar market dynamic. Managers begin hedging, diversifying, and repositioning before any actual policy changes occur. Their rational individual responses—seeking alternative suppliers, adjusting inventory levels, implementing currency hedges—aggregate into measurable market shifts that give substance to what began as mere rhetoric. The October 10th market decline wasn’t caused by implemented tariffs, but by the collective weight of managerial preparation for potential tariffs.

Who They Are

Corporate CEOs, procurement heads, legal teams, compliance officers, risk management desks, and institutional investment risk units.

How They Read

Verbal signals equal operational alerts. Managers must translate abstract “100% tariffs” into concrete cost matrices: supply chain disruption, contract defaults, tariff expenses, inventory impacts, and cash flow consequences.

Their Judgment Logic

Business continuity and regulatory compliance override wait-and-see approaches. The managerial imperative: better to over-prepare than under-react. Importantly, managerial defensive actions often impact markets more than whether policies actually materialize.

Their Actions

Immediate: Launch scenario analysis (25%/50%/100% tariff levels), convene cross-departmental emergency meetings, issue temporary procurement/inventory/hedging directives

Medium-term: Renegotiate supplier terms, implement hedging strategies (currency/commodity/tariff insurance), adjust supply chain architecture

Long-term: Redesign supply networks, establish strategic inventory buffers, accelerate domestic sourcing initiatives

Trader/Research Checklist:

Build three-tier scenario models (light/medium/heavy impact) with clear trigger thresholds for each level

Prioritize corporate announcements and supply chain disclosures as secondary intelligence sources—managerial “preparation moves” often provide more actionable signals than the original policy statements

Layer Three: Producers—The Emotionally-Driven Mass Response

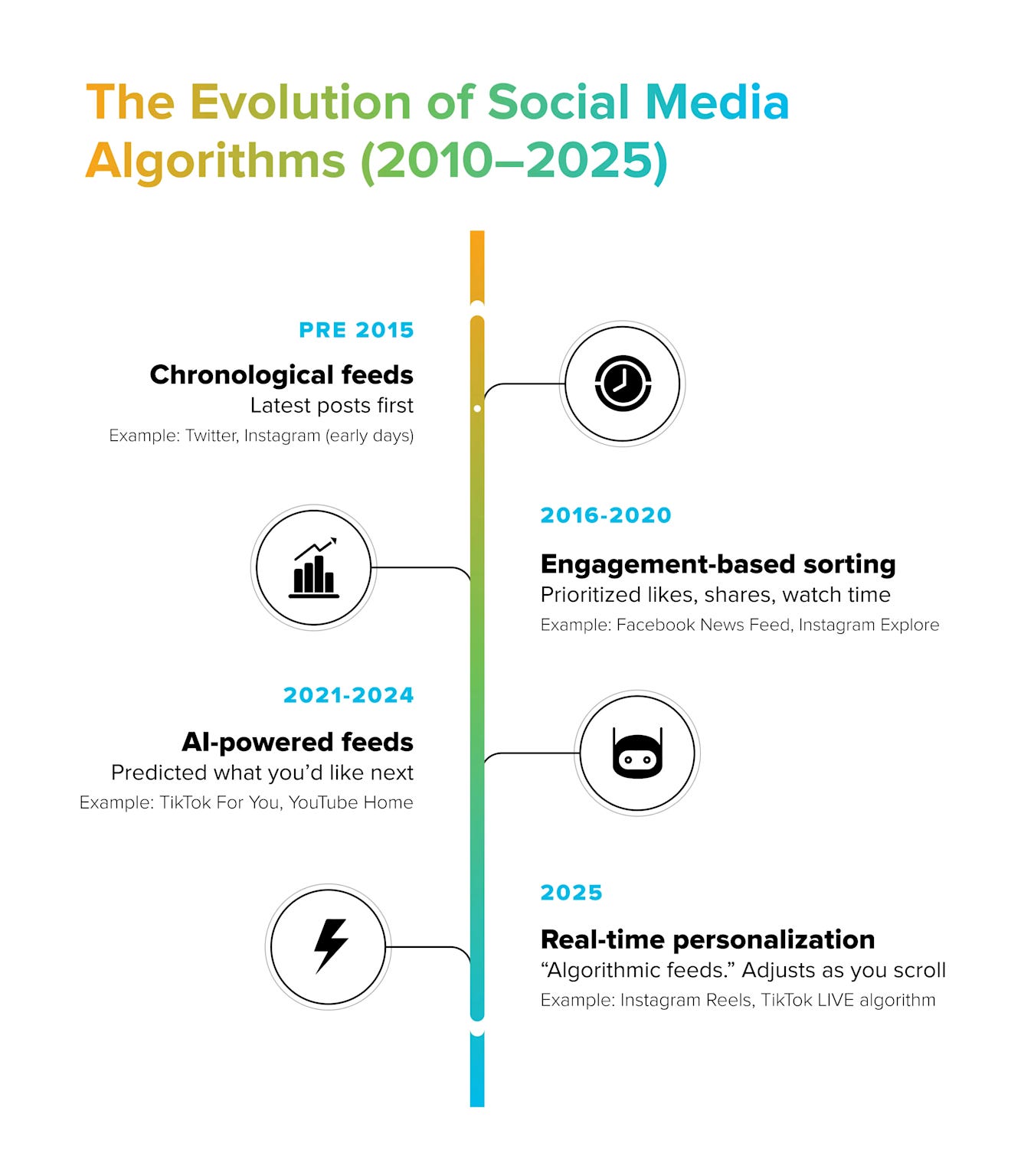

Producers—individual traders, small business owners, retail investors, workers—receive the most filtered and emotionally charged version of the same information. Their information diet consists largely of social media highlights, breaking news alerts, and algorithmic feeds designed to maximize engagement rather than comprehension. Where rule-makers see calculated ambiguity and managers see operational challenges, producers see existential threats or golden opportunities.

Who They Are

Retail investors, individual traders, small businesses, and ordinary workers—those receiving information through filtered, often sensationalized channels.

How They Read

Through news headlines, short-form videos, and algorithmic feeds that amplify extreme interpretations. They encounter “crisis-ized” or “opportunity-ized” versions of original statements.

Their Judgment Logic

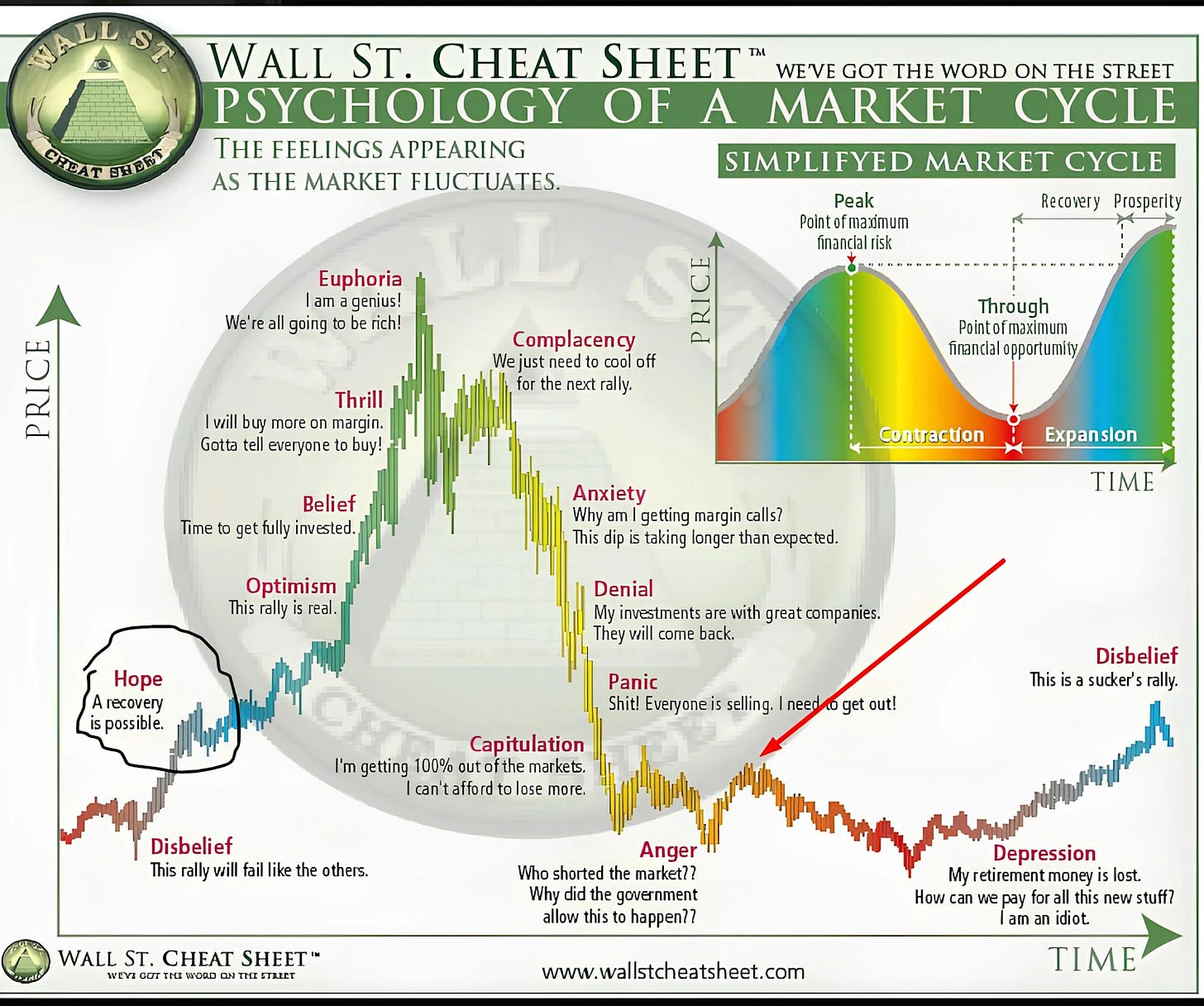

Immediate emotional response dominates: “How will this affect my portfolio/position today?” They lack time or analytical tools for complex scenario modeling. Research confirms that overconfident retail investors are particularly susceptible to panic selling during market downturns, even when possessing financial literacy.

Their Actions

Immediate: Social media-driven panic selling or momentum buying, fear-based position liquidation, or panic hoarding (corporate level)

Medium-term: Confidence erosion leading to reduced consumption or delayed investment decisions

Long-term: Sustained uncertainty erodes wealth accumulation pathways, potentially widening educational and resource gaps

Retail/Small Business/Content Audience Checklist:

Upgrade information sources: incorporate official announcements, authoritative financial media, and industry associations into your information diet

Risk buffer construction: reduce leverage, maintain cash reserves and emergency funds

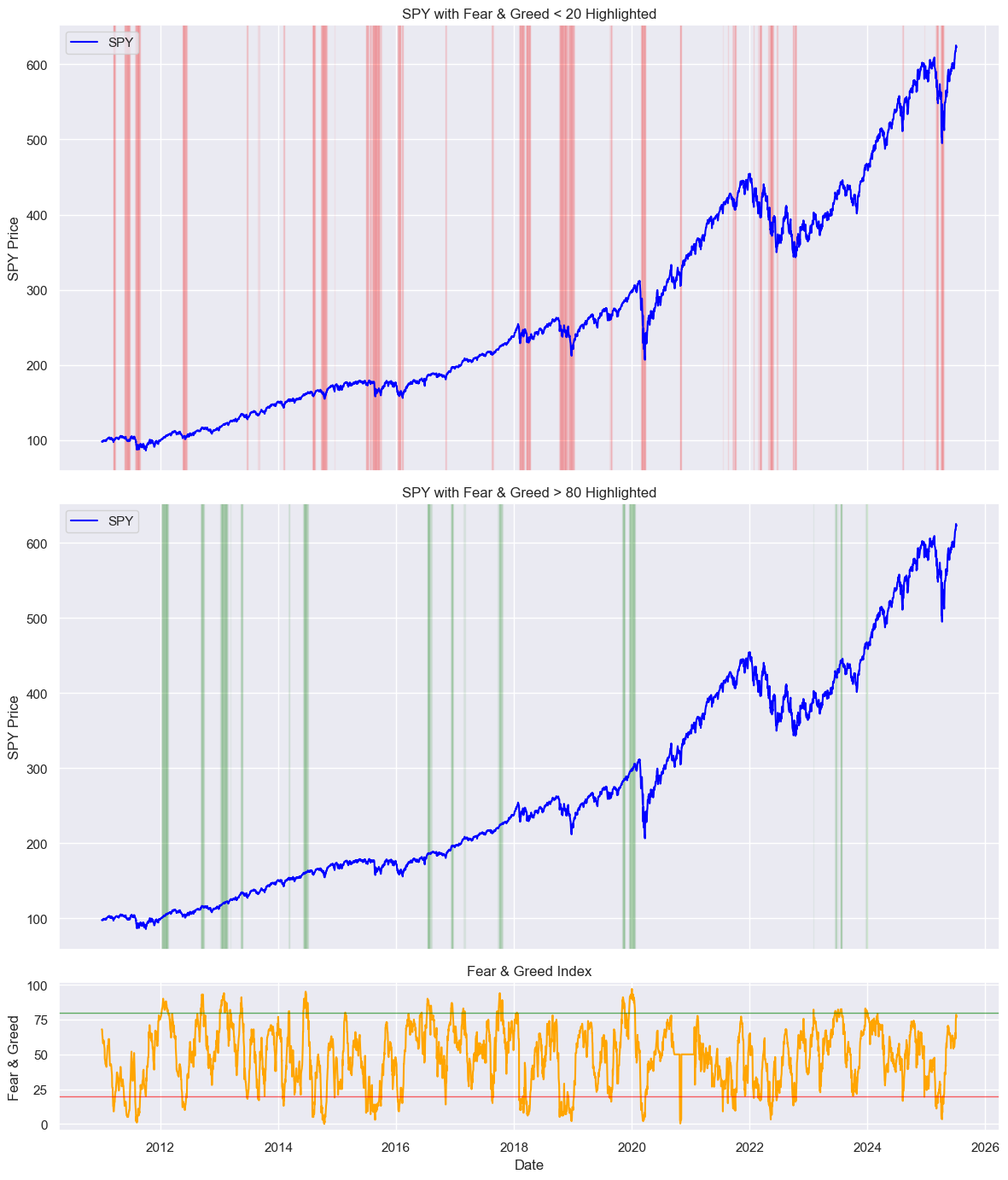

The psychology here is brutal in its simplicity: uncertainty breeds extremes. When Trump’s tariff announcement hit social media, retail investors didn’t parse the nuances of implementation timelines or exemption clauses. They saw “trade war escalation” and hit sell buttons. Technology stocks dropped 4%, semiconductors fell 6.3%, and Chinese ADRs tumbled over 8%. This wasn’t irrational—it was predictably human.

https://www.mindmathmoney.com/articles/master-market-cycles-the-psychology-behind-every-rally-and-crash

Three Hidden Filters: How Cognitive Space Gets Compressed

Don’t overdramatize the world into a “grand conspiracy theory.” What’s truly at work is a profit-driven, mechanical accumulation—algorithms, education, and media working together under the logic of self-interest to compress most people’s cognition into a “manageable, compliant version” to maintain existing rules and power structures.

1) Algorithms (Platforms)

Recommendation systems use engagement as a metric of success. Emotional, simplistic, and dramatic stories are most likely to generate clicks and shares, and are therefore prioritized. Complex institutional changes (trade rules, tax details, and regulatory provisions) struggle to gain widespread exposure quickly and are instead swallowed up by “emotional stories”—thus blinding the public to the true rules that determine long-term asset pricing.

https://www.sprinklr.com/blog/social-media-algorithm/

2) Education

Mainstream education is moving towards credentialing and job-specificity: Curriculum is oriented toward college admissions and vocational skills, while institutional knowledge (tax laws, trade, and regulatory mechanisms) is extremely low. The cost of acquiring rule-based knowledge has become a tool for class reproduction: those with resources can learn to “understand the rules,” while those without can only become “enforcers.”

3) Media

Driven by traffic, the media naturally favors short, snappy narratives like “personal comebacks” and “quick lessons learned.” Structural problems are individualized and moralized, shifting the focus of public discourse from rules to individual behavior, thereby diluting collective accountability for rule-makers.

How these three factors work together to form a closed loop (Why the problem becomes self-reinforcing)

Education limits the cognitive boundaries of most people → Algorithms and media amplify low-cost, consumable narratives → Public attention is diverted away from understanding the rules → Rule-makers adjust conditions under less scrutiny → New rules are once again embedded in education and communication channels, and the cycle continues.

Key point: A closed loop does not require a central conspiracy; it only requires each party to “function normally” according to their own logic of self-interest.

The Transmission Mechanism: How Power Travels

The speed of information transmission reveals the hierarchy’s true architecture. Rule-makers operate on political timescales—their horizon extends to election cycles and geopolitical chess moves. They can afford to be patient because they control the timing of revelations.

Managers work within operational timescales—they must respond within days or weeks to preserve business continuity. They cannot wait for policy clarity because competitive markets punish hesitation. This urgency gap creates opportunities for rule-makers to exploit: announce policy intentions early enough that managerial responses create market momentum, but retain enough ambiguity to modify course based on those very responses.

Producers react on emotional timescales—minutes to hours—because they lack both the information resources and institutional buffers to absorb uncertainty. Their rapid responses, amplified by algorithmic trading systems, create the volatility that everyone else surfs.

The October 10th sequence perfectly illustrates this cascading dynamic. Trump’s initial hints about China policy appeared around midday, triggering immediate sell-offs as retail algorithms parsed negative sentiment. By market close, institutional managers had begun implementing defensive strategies, driving down technology and industrial stocks. Meanwhile, rule-makers monitored market reactions to gauge whether their message was hitting the intended targets. The entire feedback loop was completed within hours, creating real economic effects from what remained, technically, just words.

The contagion mechanism operates as follows:

Rule signal transmission (high-level) →

Media/algorithmic amplification (prioritizing emotional content) →

Producer immediate reaction (minutes to hours) →

Manager substantive hedging and adjustments (hours to days) →

Capital reallocation (stocks→bonds/cash/precious metals) feeding back to policy makers’ observation systems

Without timely clarification or formal measures, markets are repricing supply chains and earnings expectations over longer cycles

This sequence manifested clearly in the recent episode: markets experienced significant retreat (S&P down 2.7%, Nasdaq steeper decline), with technology/semiconductor/Chinese concept stocks bearing the brunt, while safe-haven assets (Treasury bonds, gold) gained favor. Authoritative reporting documented this “word-to-wealth-transfer” cycle comprehensively.

The Asymmetry Advantage

Why do those closest to power consistently outperform those furthest from it? The answer lies not just in information timing, but in information quality. Rule-makers don’t just know what’s coming—they know what’s not coming, what’s negotiable, and what’s political theater.

Consider Trump’s pattern of tariff announcements followed by selective exemptions and diplomatic walkbacks. Rule-makers understand this as standard negotiating protocol. Managers interpret it as policy uncertainty requiring defensive positioning. Producers experience it as market chaos, demanding immediate reaction. The same information, filtered through different institutional positions, creates systematically different outcomes.

This information asymmetry isn’t accidental—it’s structural. Financial reporting requirements, regulatory compliance costs, and professional information services create natural barriers between layers. A Fortune 500 CEO has teams monitoring regulatory developments, consulting with former government officials, and maintaining Washington relationships. A day trader has TikTok and Reddit. The playing field isn’t just uneven—it’s designed to be uneven.

The wealth redistribution effects are mathematically predictable. When policy uncertainty spikes, safe assets surge and risk assets plummet. Those with advanced knowledge of policy timing can position accordingly. Those with operational requirements must hedge defensively, paying premium prices for downside protection. Those without institutional buffers experience the volatility as pure loss.

Winners and Losers

Winners: Early-informed, rule-proximate actors (policy insiders, select institutions) who can quantify verbal signals and act preemptively—they harvest the “information premium”.

Secondary winners/fee payers: Managers who protect business operations through hedging and reconfiguration, though they pay costs (insurance premiums, supply chain restructuring expenses) for this protection.

Losers: Those receiving filtered information—they enter or exit markets at emotionally-driven prices, becoming the source of wealth transfers.

The Gold Standard of Revelation

The most telling indicator of this hierarchical information processing was gold’s behavior during the tariff announcement. While stocks fell 2.7% and the dollar weakened, gold surged past $4,000 per ounce—a move that revealed sophisticated institutional positioning ahead of retail panic.

Gold doesn’t respond to headlines; it responds to fundamental uncertainty about monetary and political stability. Its surge during the tariff announcement wasn’t just safe-haven demand—it was a vote of no confidence in the predictability of rule-maker behavior. When markets choose gold over dollars during American policy announcements, they’re pricing in the possibility that policy-making itself has become a source of systemic risk.

This dynamic exposes the deeper game: rule-makers benefit from controlled uncertainty because it increases their relative value as information sources. Managers suffer from uncertainty because it forces costly defensive measures. Producers get crushed by uncertainty because they lack the resources to navigate ambiguous environments.

The Eternal Engine

Greed and fear remain the eternal drivers of market behavior, but their distribution has become increasingly unequal. Rule-makers weaponize others’ fear and greed through strategic information release. Managers must constantly balance fear of losses against greed for competitive advantage. Producers experience these emotions in their rawest form, with limited ability to act strategically.

The October 10th episode will likely be remembered as a temporary trade dispute, resolved through diplomatic channels and selective tariff implementations. But the lasting effect will be the demonstrated power of information architecture to redistribute wealth across social layers. Those who understood the game profited from volatility. Those who played defensively paid insurance premiums. Those who reacted emotionally simply transferred wealth upward.

More importantly, when information is intentionally or accidentally filtered, amplified, or obscured, the distribution of wealth gets rewritten accordingly. The next time a rule-maker tests market resolve with strategic ambiguity, remember that the message you receive has already passed through multiple layers of interpretation, each taking its cut along the way. The question isn’t whether you’re getting good information—it’s whether you understand which layer of the hierarchy you’re operating within, and how that position determines not just what you see, but what you’re capable of seeing.

The game continues, but at least now you know you’re playing it.

If you’d like to show your appreciation, you can support me through:

✨ Patreon

✨ Ko-fi

✨ BuyMeACoffee

Every contribution, big or small, fuels my creativity and means the world to me. Thank you for being a part of this journey!